Three layers of the disability pension – wide income gaps among new disability pensioners

The group of new disability pensioners includes an increasingly higher share of younger people whose income depends on the national pension or other social security benefits. At the same time, the partial disability pension has gained in popularity. For partial disability pensioners, income from work alongside the earnings-related pension is important. A total of 180,000 persons received a disability pension in Finland in 2023.

The study by the Finnish Centre for Pensions reviewed the income in 2020 of persons who started to draw a disability pension in 2019 in the form of

- a partial earnings-related disability pension,

- a full earnings-related disability pension, or

- a full disability pension paid by Kela (national pension).

“Dividing the new disability pensioners into these three groups revealed that the groups are different in terms of profile, income level and income structure. There are also differences within the groups”, explains Economist Juha Rantala of the Finnish Centre for Pensions.

Most partial disability pensioners work

The study shows that the new partial disability pensioners were most often women and aged 55–64 years.

Among the new full disability pensioners, there were equally many women and men. Most of them were aged 55–64 years, but quite a few were younger than that.

Slightly more of the recipients of a full disability pension paid by Kela were men, and for most, the pension began before age 35.

“A central difference among partial disability pensioners and the other groups concerns working. Around 90 per cent of the new partial disability pensioners received income from work alongside their pension. In other groups, the significance of income from work was minor”, says Development Manager Marjukka Hietaniemi from the Finnish Centre for Pensions.

Partial disability pensioners have highest income level – Kela pensioners lowest

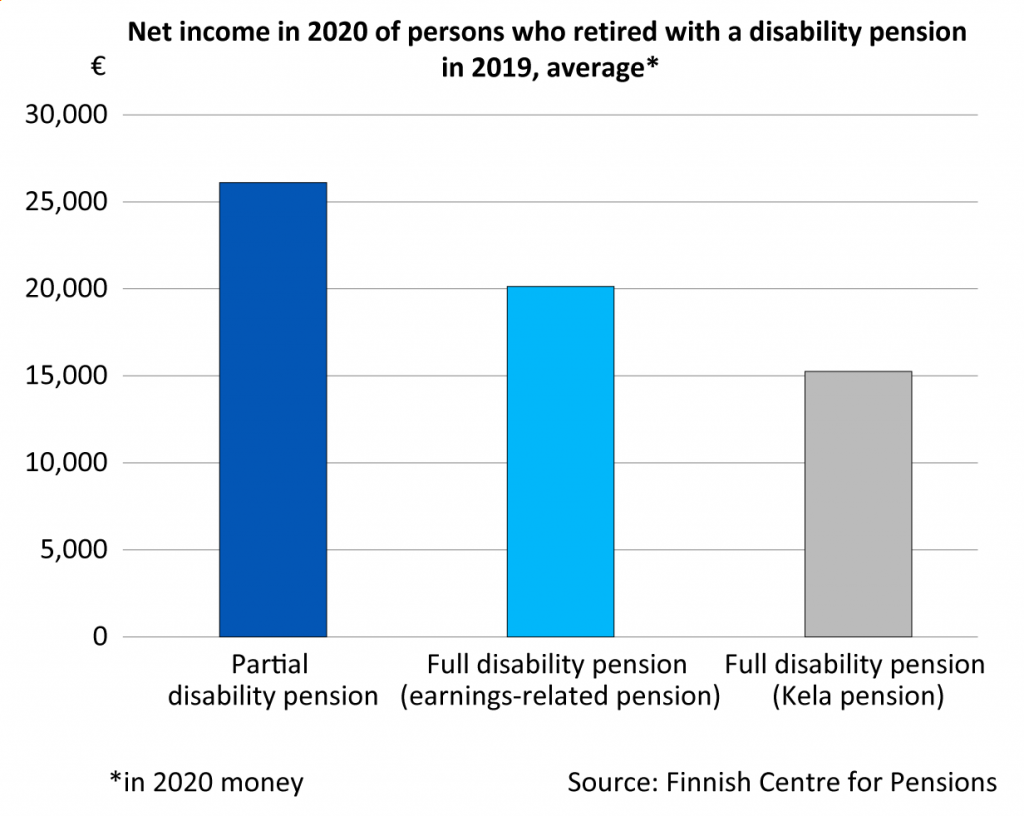

New pensioners with a partial disability pension had the highest income level: 26,000 euros per year (ca €2,170/month). This was about one third higher than of those who retired with a full disability pension. Their average annual net income was 20,100 euros (ca €1,680/month).

The clearly lowest income level was among those who retired with a Kela pension. Their average annual net income was just over 15,300 euros (ca €1,275/month).

Income structure varies between groups of disability pensioners

Of the gross income for those who retired with a partial disability pension, the earnings-related pension accounted for around 30 and the income from work for an ample 50 per cent on average. For those who retired with a full disability pension, the equivalent ratios were 65 and less than 10 per cent.

Most new partial disability pensioners earned an income from work that was at least as high as the partial disability pension they received.

For those receiving a full disability pension from Kela, the pension made up two thirds of their gross income and other income transfers one third. The other income transfers, such as the housing and care allowances for pensioners, were hence important for those who received a Kela pension only.

Three layers of disability pension recipients

- In 2019, 25 per cent of the new disability pensioners drew a partial and 66 per cent a full earnings-related disability pension. 9 per cent drew only a full disability pension paid by Kela.

- The partial disability pension is granted if the person’s ability to work has been reduced by at least 40 per cent. The full disability pension is granted if the person’s ability to work has been reduced by at least 60 per cent. A partial disability pension is half of the amount of a full disability pension.

- Kela pays out full disability pensions only. Persons with an illness, handicap or injury that prevents them from earning a reasonable income may be eligible to receive a full disability pension from Kela.

- In this study, income was measured based on net income. In addition to pensions, net income consists of the individual’s gross income, such as wage and property income, from which taxes have been withheld.