Three in five self-employed intend to work past retirement age

The self-employed expect to continue working past retirement age clearly more often than employees. The biggest reason for staying on is having enjoyable and inspiring work, but financial reasons come into play as well. Only half of the self-employed feel they are paying enough to provide sufficient pension cover. Some plan to continue working because they haven’t accumulated sufficient pension cover.

Almost two-thirds (62%) of the self-employed plan to continue working after they have reached retirement age. Around one in five expect to work until retirement age. One in eight self-employed persons intend to stop working before retirement age.

These are some of the major findings of a new study by the Finnish Centre for Pensions on self-employed persons’ retirement intentions and perceived working conditions.

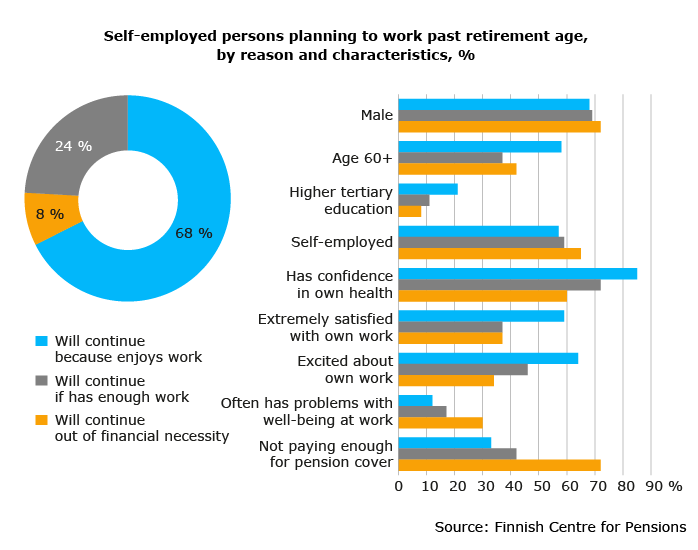

The self-employed expect to remain at work beyond retirement age twice as often as employees. Two in three self-employed persons say they will continue to work because they enjoy it. Commitment to work, a high level of influence and a sense of enthusiasm increase intentions to stay on.

Age and education also influence plans to stay on at work.

“Typically, the self-employed who expects to continue to work is a highly educated male aged over 60 who is excited about his work and who believes he is in good enough health to keep working until retirement age,” says Finnish Centre for Pensions economist Satu Nivalainen.

One-third of the self-employed feel they are not paying enough to provide sufficient pension cover

One in four self-employed persons intend to continue to work past retirement age if they have enough work. One in twelve plan to continue out of financial necessity.

Among the self-employed who say they will have to stay on for financial reasons, a higher proportion than in other groups report high levels of work-related stress and doubts about their health holding up. Furthermore, they more often live alone and feel they have not put enough into their pension pot.

Only about half of all self-employed persons say they are paying enough to provide sufficient pension cover. One-third feel they are not paying enough. The remaining respondents were unable to say or paid no pension contributions at all because they were already retired.

“Our results show that the financial necessity to continue working is associated with inadequate future pension cover, in other words some self-employed persons decide to stay on longer in order to top up their meagre pension fund,” says Finnish Centre for Pensions economist Sanna Tenhunen.

Half of the self-employed extremely satisfied with their work

Almost one-third of the self-employed said they worked at least 50-hour weeks, and around one-third felt that they neglected home because of work.

On the other hand, almost half (45%) said they were extremely satisfied with their work, and the same proportion that they were excited about their work.

“The self-employed are more satisfied and more committed to their work than employees. They have greater influence over their jobs, but on the other hand higher workload stress as well,” Nivalainen explains.

The study is based on data collected for Statistics Finland’s Labour Force Survey. A total of 1,250 self-employed persons aged 50 or over were asked about their retirement intentions.

Publication:

Yrittäjien eläkeaikeet – työolojen ja eläketurvan merkitys. Eläketurvakeskuksen tutkimuksia 1/2019.

[Retirement intentions of the self-employed – the role of working conditions and pension security. Finnish Centre for Pensions, Studies]

More information:

Satu Nivalainen, economist, phone +358 29 411 2151, satu.nivalainen(at)etk.fi

Sanna Tenhunen, economist, phone +358 29 411 2492, sanna.tenhunen(at)etk.fi

Photo: iStock