Effective retirement age

The statistics represents the retirement age within Finland’s earnings-related pension system, using three central statistical indicators: the expected effective retirement age, the median retirement age and the average retirement age. Each indicator offers a unique way to interpret the retirement age and is appropriate for different analytical contexts.

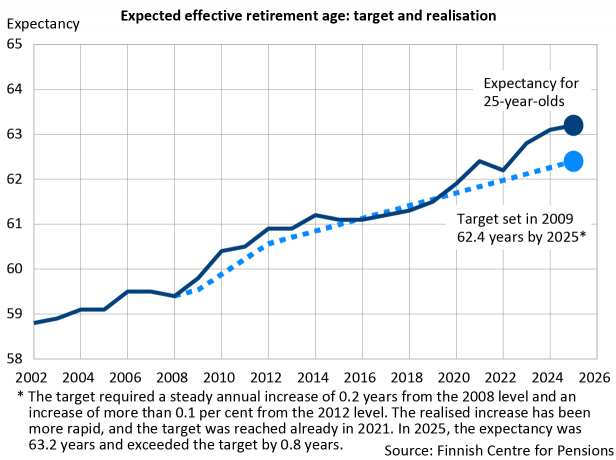

Effective retirement age exceeded target by 0.8 years

- The expected effective retirement age within the earnings-related pension scheme was 63.2 years in 2025.

- The increase in expected effective retirement age was 0.1 years compared with 2024.

- The target for the increase in the effective retirement age increased by nearly 10 months.

- A total of 60,200 persons retired on an earnings-related pension. Around 42,500 of them re-tired on an old-age pension.

In 2025, the expected effective retirement age within the earnings-related pension scheme was 63.2 years. This figure exceeded the minimum target (62.4 years) for the increase in retirement age by 0.8 years (approximately 10 months). This is an increase of 0.1 years compared with the previous year.

The increase in the expected effective retirement age in recent years has aligned with projections, despite the target already being clearly exceeded. The main reason for this increase is the change in the retirement age for the old-age pension in recent years. In 2025, those born between 1 July 1960 and 31 March 1961 reached their retirement age. The expected effective retirement age of a 50-year-old grew by 0.1 years to 64.7 years.

The lowest possible target that was agreed on in 2009 was already reached in 2021, when the expected effective retirement age went up to 62.4 years. This is the same as the target. The following year, however, the expectation fell due to an exceptionally high number of insured persons retiring. In 2023–2025, there have been fewer new retirees on an old-age pension, and their average age has risen year-by-year. This has increased the effective retirement year considerably.

The number of new retirees on a disability pension increased by 1 per cent from 2024. Between 2021–2025, the annual number of people retiring on a disability pension has been the lowest in the 2000s. Fewer than 18,000 disability pensions have started each year although pensions are now also granted to people aged 63. The low number or new disability pensions in 2025 is highlighted also by the fact that 2,300 of them were aged 63–64 years.

In 2025, a total of 60,200 persons retired on an earnings-related pension. Around 42,500 of them retired on an old-age pension. Compared to 2023, the number of new retirees rose by 2,300 insured persons.

In 2025, the expected effective retirement age was 63.5 years for men and 62.8 years for women. While the difference in retirement ages between men and women has traditionally been small, the gap has widened to over six months since the mid-2010s. It has remained at this level ever since. In 2025, the expected effective retirement age for men was 0.7 years higher than for women.

Particularly at the start of their working lives, women are more likely than men to retire on a disability pension, which lowers their average expected effective retirement age more than that of men. In other respects, the effective retirement age is the same for men and women. In the public sector, which is dominated by women, the expected effective retirement age is slightly lower than in the private sector.

Expected effective retirement age for 25-year-olds and 50-year-olds, years

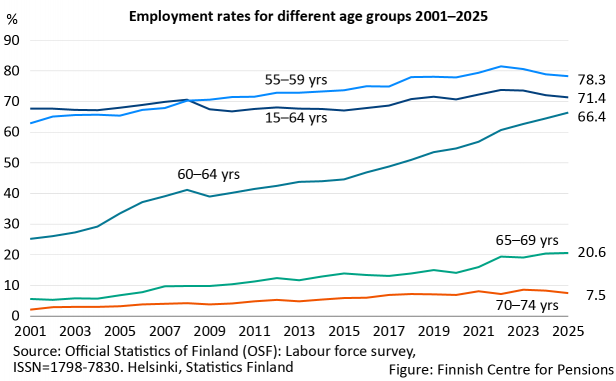

Employment of older people (55-64 years) shows strong growth

Employment growth slowed in 2025 but continued for the over-60-year-olds

- The employment rate of the working-age population was 71.4% in 2025 (down by 0.7 percentage points from 2024).

- The employment performance of older workers has been good in the 2000s

- The employment rate for the 55–59 age group fell by 0.6 percentage points from the previous year. This is down 3.2 percentage points from the historical peak in 2022.

- The employment rate for those aged 60–64 years has increased by around two percentage points every year since 2009. In 2025, it was 66.4 per cent. The increase was 1.9 percentage points from the previous year.

- The employment rate of 63-year-olds has risen by more than 25 percentage points since 2017. It was 63.5 per cent in 2025.

- The employment rate of 64-year-olds has nearly doubled compared to 2020. In 2025, it exceeded 50 per cent for the first time.

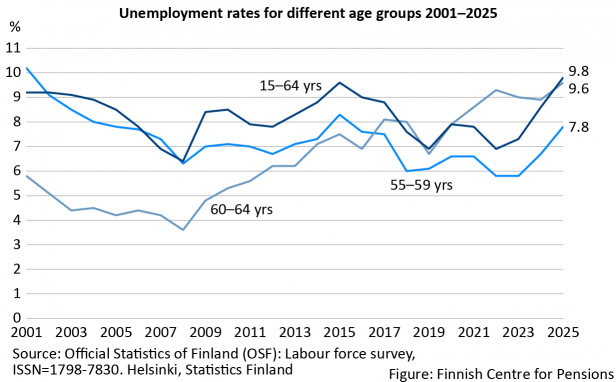

Unemployment rate varies by age group

- The unemployment rate for people aged 55–59 follows, but is significantly lower than, the unemployment rate for the working age population as a whole.

- The unemployment rate among individuals aged 60–64 has increased markedly since the 2008 financial crisis. In 2025, it matched the unemployment rate observed across the entire population.

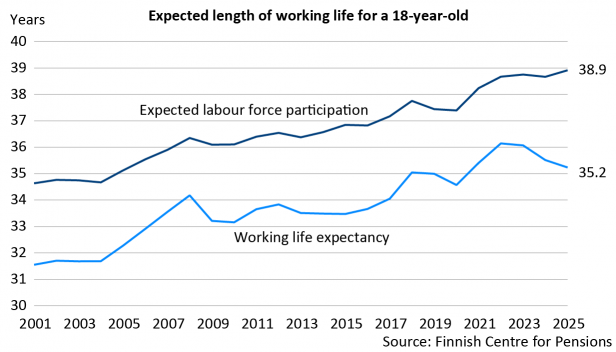

Length of working life in 2025

Expected labour force participation of an 18-year-old was 38.9 years

- Up by 0.2 years from 2024.

- Up by 4.6 years in the 2000s.

- 39.2 years for men (up by 4.1 years in the 2000s).

- 38.6 years for women (up by 5.1 years in the 2000s).

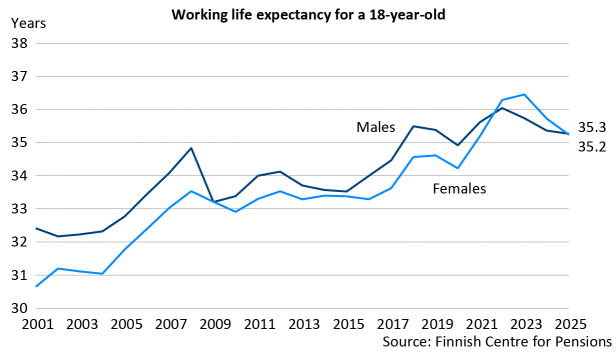

Working life expectancy for 18-year-olds was 35.2 years

- Down by 0.4 years from 2024.

- Up by 4.5 years over the 2000s.

- 35.3 years for men (up by 3.3 years in the 2000s).

- 35.2 years for women (up by 5.2 years in the 2000s).

(Updated on 13 February 2026)

Statistical tables:

Read more on Etk.fi:

Our expert in this area:

- Jari Kannisto

firstname.surname@etk.fi

Statistical services provides further information:

News and press releases:

- Press release 13 Feb 2026: Finns delay retirement faster than predicted

- Press release 10 Feb 2025: Effective retirement age continues to rise rapidly

- Press release 14 Feb 2024: Effective retirement age above target

- Press release 14 Feb 2023: Effective retirement age dipped as expected

- Press release 24 May 2022: Highest effective retirement age in Sweden – Finland among the top three

- Press release 9 Feb 2022: Effective retirement age on the rise for the second year in a row

- Press release 25 Feb 2021: Effective retirement age rose briskly in the year of the coronavirus

- Press release 27 Feb 2020: Effective retirement age risen clearly

- Press release 8 Feb 2019: Age at retirement continues to rise

Tables in our statistical database:

Previous releases in the shared open repository Julkari:

Statistical publications in the shared open repository Julkari:

Effective Retirement Age

Producer: Finnish Centre for Pensions

Website: Effective Retirement Age

Subject area: Social security

Part of the Official Statistics of Finland (OSF): No

Description

These statistics describe the effective retirement age under the Finnish earnings-related pension scheme.

Data content

Effective retirement age is described by three measures of central tendency: expected effective retirement age, median age and average age.

Categorizations

Sector of employment, gender, age, pension benefit

Methods of data collection and source

The statistics are based on register data from the earnings-related pension scheme.

Update frequency

Once a year.

Time of completion or release

The statistics are released in the February of the year following the statistical year. The exact date of publication is given in the release calendar, go to www.etk.fi/en/statistics-2/statistics/release-calendar/.

Time series

The time series for the statistics start from 1996. Private sector time series extend back to 1983.

Key words

social insurance, pension, earnings-related pension, retirement, effective retirement age

Contact information

Expected effective retirement age

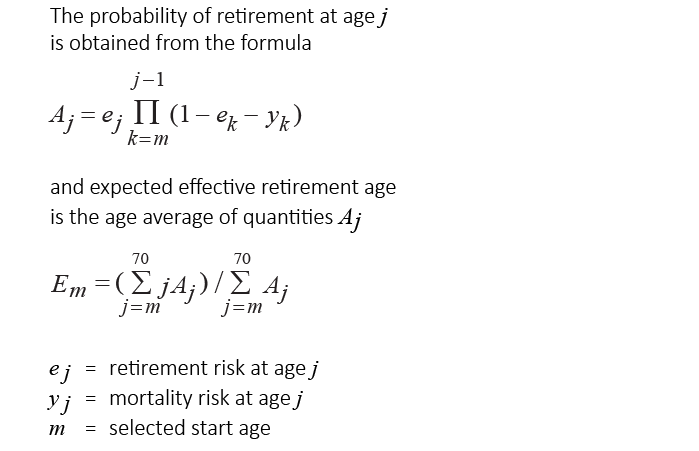

Expected effective retirement age is an indicator developed by the Finnish Centre for Pensions for the measurement of effective retirement age. The indicator is unaffected by the population age structure. It describes the average effective retirement age for persons of a certain age who are insured under the earnings-related pension scheme, proceeding from the assumption that the retirement and mortality rates for each age group are unchanged from the year of observation.

Expected effective retirement age is calculated for both 25-year-olds and 50-year-olds. The expectancy for 25-year-olds describes the effective retirement age for the whole population with earnings-related pension insurance, and it is used as the official indicator to describe changes in effective retirement age.

The expectancy for 50-year-olds is calculated for insured persons who have reached the age of 50. As persons who have retired before age 50 are not included in the calculation, the expectancy for 50-year-olds is always higher than for 25-year-olds. The difference describes the impact that people retiring at age 25–49 have on effective retirement age.

Of the three indicators used, expected effective retirement age provides the most accurate measure of changes over time in effective retirement age.

Average

Average retirement age is the arithmetic mean of the ages of new retirees. Average age is calculated based on age at the onset of retirement.

Average is the most commonly used indicator in international comparisons of effective retirement age.

Median

Median retirement age is the midpoint observation for the dataset, i.e. half of the new retirees are younger and the other half older than the median. Median age is calculated based on age at the onset of retirement.

Median is well-suited to describing the typical effective retirement age in a highly skewed distribution.

New retirees on earnings-related pension

New retirees on an earnings-related pension are defined as persons whose pension based on their own employment started during the statistical year, or whose pension eligibility has started earlier but who have only received a decision on their pension during the statistical year. A further requirement is that the person has not received any employment-based pension in one’s own right (excluding part-time pension and partial early old-age pension) for at least two years.

Figures for different types of pension benefit require that the person has not received the pension benefit in question for two years. For new retirees on an old-age pension, the person shall not have received any employment-based pension in one’s own right (excluding part-time pension and partial old-age pension) for two years.

Statistics for partial early old-age pension, which was introduced in 2017, are compiled using the same rules as for part-time pension. In other words, persons who have chosen to take early payment of a partial old-age pension are not counted as new retirees.

Survivors’ pensions are excluded from the examination of new retirees.

Sector-specific examinations are always focused on the sector concerned, i.e. the number of new retirees is determined based on pensions within that sector alone. In the case of the entire earnings-related pension system, it is required that the person has not received a pension from either sector for two years.

Insured persons

In this set of statistics persons insured for an earnings-related pension are defined as persons covered by the pension system who do not receive an employment-based pension (excluding part-time pension and partial old-age pension). The population insured for an earnings-related pension in the year under review is calculated based on the corresponding number at the end of the previous year.

The earnings-related pension scheme consists of the private and the public sector. Around three in four persons insured under this scheme are employed in the private sector and one in three in the public sector. Over the course of the year less than ten per cent work in both sectors.

Private sector pension acts:

- Employees’ Pensions Act

- Seafarers’ Pensions Act

- Self-Employed Persons’ Pensions Act

Farmers’ Pensions Act - Act on Farmers’ Early Retirement Aid

Public sector pension acts:

- Public Sector Pensions Act

- Pension acts concerning Bank of Finland employees,

- the regional government of the Åland Islands, and

- Members of Parliament and the Council of State.

The introduction of the Public Sector Pensions Act on 1 January 2017 combined and replaced the Local Government Pensions Act, the State Employees’ Pensions Act, the Evangelical-Lutheran Church Pensions Act and a separate act concerning employees of the Social Insurance Institution of Finland.

1. Contact

1.1 Contact organisation

The Finnish Centre for Pensions

1.2 Contact organisation unit

Planning Department

1.3 Contact name

1.4 Contact person function

Statistical expert

1.5 Contact mail address

The Finnish Centre for Pensions

FI-00065 ELÄKETURVAKESKUS

Finland

1.6 Contact email address

firstname.lastname@etk.fi

Contact form

1.7 Contact phone number

+358 29 411 20

1.8 Contact fax number

Fax: +358 9 148 1172

2. Metadata update

2.1. Metadata last certified

13 February 2026

2.2. Metadata last posted

10 February 2025

2.3. Metadata last update

10 February 2025

3. Statistical presentation

3.1. Data description

The statistics represents the retirement age within Finland’s earnings-related pension system, using three central statistical indicators: the expected effective retirement age, the median retirement age and the average retirement age. Each indicator offers a unique way to interpret the retirement age and is appropriate for different analytical contexts.

3.2. Classification system

Gender, employment sector, pension benefit

3.3. Sector coverage

The statistics covers all persons who have retired from Finland’s earnings-related pension system.

The following pension benefits are included in the statistics:

- old-age pension

- disability pension

- unemployment pension (up to 2011)

- part-time pension (up to 2017)

- partial old-age pension (from 2017 onwards).

The statistics also covers pensions received in one’s own right, which include old-age pensions, disability pensions and unemployment pensions.

The statistics include only statutory earnings-related pensions. This means that, for example, voluntary supplementary pensions are excluded.

3.4. Statistical concepts and definitions

Concepts and definitions have been presented on the statistics page.

3.5. Statistical unit

Person

3.6. Statistical population

Persons who have retired from the Finnish earnings-related pension system.

3.7. Reference area

Finland

3.8. Time coverage

The statistics have been compiled since 2003, and time series have been produced retrospectively back to 1996. Private sector time series extend to 1983.

4. Unit of measure

Age in years

5. Reference period

Calendar year

6. Institutional mandate

6.1. Legal acts and other agreements

The Act on the Finnish Centre for Pensions states that one of the responsibilities of the institution is to compile statistics in its field of operations.

6.2. Data sharing

Some of the data in the statistics are published in the Sotkanet Indicator Bank maintained by the Finnish Institute for Health and Welfare (THL).

7. Confidentiality

7.1. Confidentiality – policy

The Finnish Centre for Pensions is committed to data protection as a fundamental principle of statistics, which ensures the confidentiality of data.

7.2. Confidentiality – data treatment

Data is protected by the necessary physical and technical solutions at the various stages of processing. Personnel have access only to the data necessary for their work. Third parties do not have access to the premises where the data is processed. Employees are required to sign a confidentiality agreement when they are hired.

8. Release Policy

The statistics of the Finnish Centre for Pensions are released on weekdays at 9.00 a.m. on the website of the Finnish Centre for Pensions. Any exceptions to the release time are announced separately.

The data in the statistical database are released as open data. The database’s open interface can be freely used under the CC BY 4.0 licence, with the Finnich Centre for Pensions being cited as the source of the statistical data.

8.1. Release Calendar

The release dates of the statistics are published in the release calendar. The release calendar for the following year is published towards the end of the year.

8.2. Release calendar access

8.3. User access

The statistics are available to everyone when they are published on the website of the Finnish Centre for Pensions at a previously announced date.

Embargo policy: Media that are bound by the journalist’s guidelines may request material from the Finnish Centre for Pensions’ Communications Department.

9. Frequency of dissemination

The statistics are published once a year.

10. Accessibility and clarity

10.1. News release

The releases of the statistics can be found in the shared open repository Julkari.

Effective retirement age (Julkari).

Press releases on this topic can be found online at the website of the statistics.

10.2. Publications

10.3. Online database

Effective retirement age (PxWeb)

10.4. Microdata access

–

10.5. Other

–

10.6. Documentation on methodology

The methods used have been documented in the methodological description of the statistics.

11. Quality Management

11.1. Quality assurance

The Finnish Centre for Pensions is committed to the quality principles of Official Statistics of Finland. Our statistical production follows the quality criteria of Official Statistics of Finland, which are compatible with the European Statistics Code of Practice.

11.2. Quality assessment

The quality of statistics is assessed at several stages in the statistical process.

12. Relevance

12.1. User needs

Feedback from users is gathered through customer surveys. Feedback is also collected through direct contact. The feedback received is monitored and taken into account in the development of the statistics.

13. Accuracy and reliability

13.1. Overall accuracy

The data are based on administrative registers. The source information is on an individual level, based on which pensions are paid.

13.2. Sampling error

–

13.3. Non-sampling error

The data from the registers are extracted at the beginning of the year, so some of the backdated pension decisions may be missing from the statistical data.

14. Timeliness and punctuality

14.1. Timeliness

The statistics is released once a year, in February following the statistical year.

15. Coherence and comparability

15.1. Comparability – geographical

The statistics does not include regionally classified data.

15.2. Comparability – over time

The statistical time series has been produced retrospectively back to the statistical year 1996, ensuring data comparability throughout the entire period. When interpreting the statistics, it is important to consider changes that have occurred in the earnings-related pension legislation.

Year-by-year changes in earnings-related pension legislation

15.3. Coherence – cross domain

Differences in the definitions of concepts may make comparisons with other statistics covering the same statistical domain difficult.

15.4. Coherence – internal

The data in the statistics are coherent with those of the statistics ”Earnings-related pension recipients in Finland” (OSF) and ”Persons insured for earnings-related pension in Finland” (OSF).

16. Cost and burden

The production of the statistics is financed annually by the Finnish Centre for Pensions.

17. Data Revision

–

18. Statistical processing

18.1. Source data

The statistics is based on data in the statistics ”Earnings-related pension recipients in Finland” (OSF) and ”Persons insured for earnings-related pension in Finland” (OSF).

18.2. Frequency of data collection

–

18.3. Data collection

Administrative registers.

18.4. Data validation

Adjustments are made at different stages of statistical production in accordance with the production processes of the Finnish Centre for Pensions. In addition, the results are compared with changes in legislation and with data from previous statistical years.

18.5. Data compilation

The data processing is described in the statistics’ Methodological description.

Definition and method of calculating expected effective retirement age

The expected effective retirement age describes the average effective age of retirement for insured persons of a certain age, assuming that the retirement risk and mortality for each age group remain unchanged at the level of the year of observation.

The expected effective retirement age is obtained by first calculating the mortality and retirement rates for each age group in the year of observation. These rates can then be used to calculate the number of people who in a group of insured persons of a selected size and age (say 100,000 insured persons aged 25 years) would retire within one year.

The number of persons insured at age 26 is then obtained by deducting from the original number those who have retired and the number of deceased persons based on mortality rates. This is repeated one year at a time through to retirement age until the notional number of new retirees is obtained for all age groups. The average age of these notional new retirees is the expected effective retirement age.

Expected effective retirement age is calculated as follows:

Until the end of 2004 the general retirement age in Finland was 65 years. For 2004 and earlier, therefore, the termination age used in the formula was 65 years. With the introduction in 2005 of flexible old-age retirement between ages 63 and 68, the upper limit in the formula was increased to 70 years. It is estimated that this hike in the termination age from 65 to 70 years increased the expected effective retirement age by just over 0.1 years.

Requirements set for expected effective retirement age

- The indicator reacts correctly to changes in the number of starting pensions. It falls if the number of starting pensions rises in any of the age groups below retirement age, and rises if the number of starting pensions falls.

- The indicator only reacts to changes in the number of starting pensions. It is unaffected by demographic phenomena such as the population age structure.

- The indicator reacts immediately to changes in the number of starting pensions since the calculations are based on starting pensions. If the calculations were based on the number of retired persons, the changes would be slow to show up in the results.

- The statistical data needed to calculate the indicator are available. The Finnish Centre for Pensions maintains a central register of all earnings-related pensions and persons insured for an earnings-related pension, which allows for calculations based on the number of starting pensions.

The indicator of expected effective retirement age satisfies these four basic requirements.

It might be tempting to add to this list the requirement of international comparability, but it may be difficult to obtain comparable data other than for the Nordic countries.

Calculations of expected effective retirement age for a very small population will also have limited value because the number of starting pensions should describe the probability of retirement for each age cohort of the population. It follows that calculations of expected effective retirement age for the personnel of an individual company, for example, are not meaningful.

Aim to defer effective retirement age

Since the 1990s, efforts have been made to contain the upward pressure on pension contributions. Extending working lives and raising the retirement age have emerged as key measures. Changes in working life are mainly monitored by the employment rate of older people and the retirement age by the expected effective retirement age developed by the Finnish Centre for Pensions.

- The 2005 pension reform set the long-term goal of delaying retirement by 2–3 years. The exact time frame for achieving this goal was not specified.

- In the spring of 2009, the government and the social partners negotiated a more precise increase target: the expected retirement age should rise to at least 62.4 years by 2025. At a steady pace, the expected effective retirement age should have increased by almost 0.2 years per year.

- The 2011 government programme reaffirmed the target for increasing the expected effective retirement age.

- The 2013 structural policy programme also confirmed the target of increasing the expected effective retirement age to at least 62.4 years by 2025. Achieving this target at that time required an annual increase of just over 0.1 years.

- In the explanatory memorandum to the 2017 pension reform, the target for the expected effective retirement age was still set at 62.4 years.

- In 2021, the target was reached, but in 2022 the expected retirement age fell by 0.2 years. In 2025, the minimum target was exceeded by 0.8 years, with an increase to 63.2 years.