Disability pensions and work ability

The number of people retiring on disability pension has clearly decreased during the 2000s. Nevertheless, working life still ends prematurely for many due to disability. Work ability is increasingly supported in various ways to make it easier to continue working despite health problems.

Research on disability pensions and how to support work ability produces important information for the development of pension and rehabilitation systems.

Disability retirement

Around 20,000 persons retire on a disability pension each year. Of them, around 5,000 retire on a partial disability pension. It is important to study disability retirement by population groups to be able to identify factors affecting disability retirement.

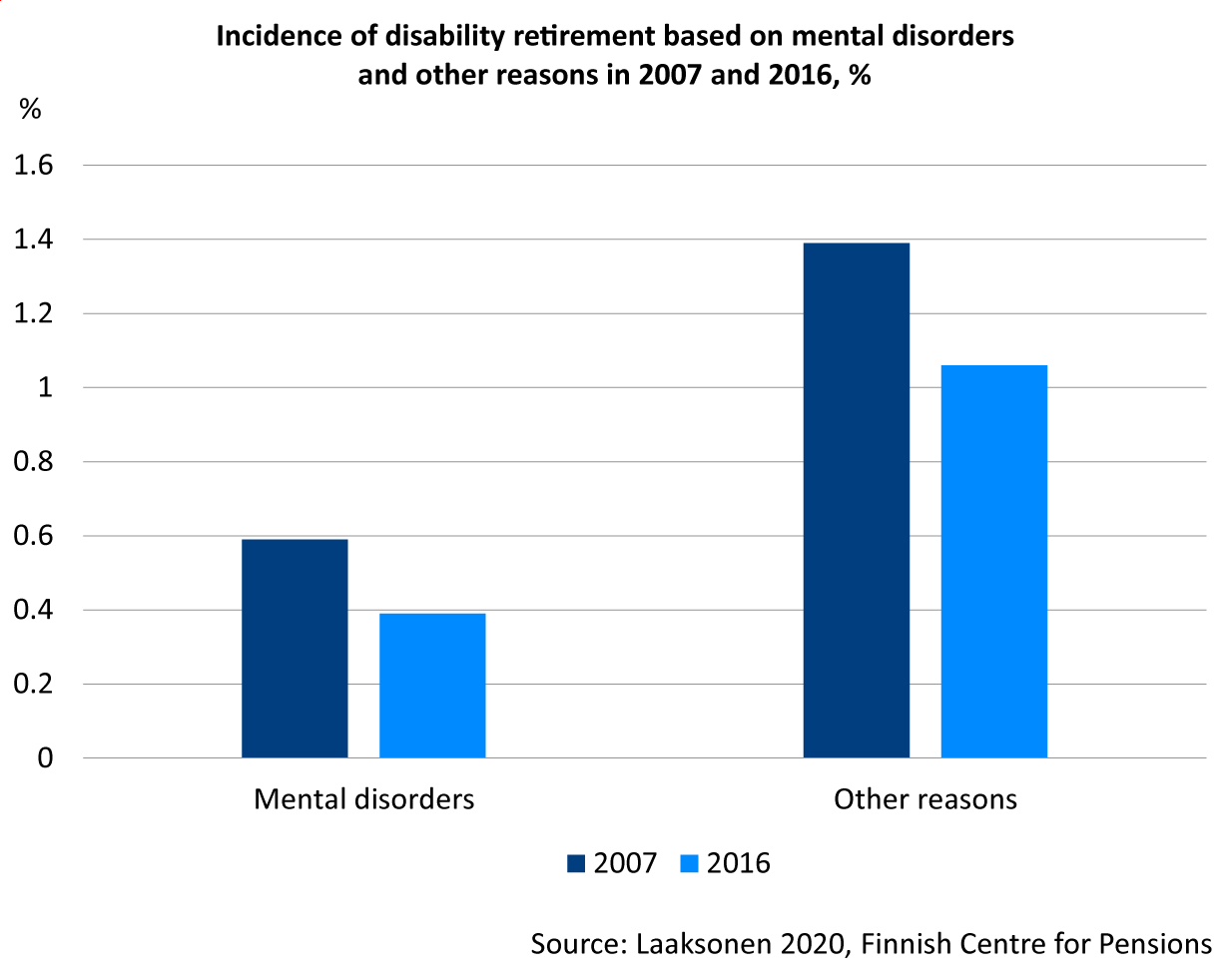

The incidence of disability retirement in Finland has sharply declined over the past 15 years. The decline has been larger for pensions granted due to somatic diseases than for those granted due to mental and behavioural disorders.

In recent years, the development has fluctuated. In 2018 and 2019, the incidence of disability retirement in Finland increased, mainly because of the growth in the incidence of disability retirement due to mental disorders. In 2020 and 2021, on the other hand, the incidence of disability retirement strongly decreased. This was probably because of the corona pandemic. Since then, the incidence of disability retirement has increased slightly again.

Disability retirement has declined particularly among the over-55-year-olds. Among those aged 60 or over, the incidence of disability retirement has increased, mainly because drawing a partial disability pension has become increasingly common. However, younger age groups are seeing a decline in the transition to partial disability pensions. The rising retirement age for the old-age pension is expected to increase the transition to disability pensions among the oldest working-age individuals.

The share of women receiving a disability pension has increased. At the beginning of the century, the incidence of disability retirement was higher among men than women, but currently, a clear majority of new disability pensioners are women.

More on other sites:

Publications:

- Laaksonen 2020. Retirement on disability pension: trends, current situation, future outlook (Julkari, Summary in English)

- Laaksonen 2024. Incidence of disability retirement among persons aged 50 and over by birth cohort (Julkari, summary in English)

- Laaksonen et al. 2019. Did the Activation Model for Unemployment Security affect applying for and receiving a disability pension? (Summary in English, Julkaisuarkisto Valto)

- Laaksonen & Nyman 2019. Retirement due to disability has decreased among the unemployed and older Finns of working age (Julkari, Summary in English)

- Laaksonen & Rantala 2023. Mistä työkyvyttömyyseläkkeellä olevien määrän väheneminen johtuu? [What causes the reduction in number of disability pension recipients?]. (Julkari)

In the early 2000s, disability retirement due to mental disorders and somatic diseases decreased clearly. In recent years, however, the incidence of disability retirement due to mental disorders has increased. It follows that mental disorders play an increasingly greater role in disability retirement.

Currently, around one third of all disability pensions are granted due to mental disorders. This type of disability retirement typically starts at a younger-than-average age. Already more than half of all disability pension recipients receive the pension due to mental disorders.

The spectrum of mental disorders is varied. Disability retirement based on depression and anxiety disorders has increased while disability retirement due to psychotic disorders has decreased. Throughout the 2000s, disability retirement based on mental disorders has decreased in older age groups but increased steadily in younger age groups. It is not clear whether mental disorders among young people have increased or whether, for whatever reason, they lead to disability retirement more frequently than before.

Publications:

- Laaksonen 2020. Retirement on disability pension:

trends, current situation, future outlook (Summary in English, Julkari) - Laaksonen & Nyman 2019. Retirement due to disability has decreased among the unemployed and older Finns of working age (Summary in English, Julkari)

- Laaksonen et. al. 2015. Sickness allowance histories among disability retirees due to mental disorders: A retrospective case–control study (Julkari)

- Laaksonen et al. 2021. The incidence of disability retirement due to mental disorders has increased among young people but decreased in older age groups (Summary in English, Julkari)

- Pirkola et al. 2015. The importance of clinical and labour market histories in psychiatric disability retirement. Analysis of the comprehensive Finnish national level RETIRE data (SpringerLink)

Overall, disability retirement is clearly more frequent among the older age groups. It increases particularly among those who are 50 or older. Nevertheless, disability retirement among the young has gained much attention and caused great concern since, unlike in the older age groups, disability retirement of the young has increased steadily throughout the 2000s.

Mental disorders are clearly the most common disease group among young disability pensioners. The share of disability retirement due to depression increases while that due to psychotic disorders decreases the older the age group.

Underlying the growth in the disability retirement incidence among the young is an increase in the incidence of pensions granted due to mood disorders (depression and anxiety).

Most disability pensions of the young are granted as fixed-term disability pensions. Fixed-term pensions are less often converted to permanent pensions in the younger age groups compared to the older age groups. However, young people tend to be on fixed-term pensions for a longer time than older people.

Incidence of disability retirement based on mental disorders for under-35-year-old men / 10,000 person-years

| Diagnosis | 2007 | 2011 | 2015 | 2019 |

|---|---|---|---|---|

| Total | 15.6 | 16.7 | 18.4 | 20.7 |

| Depression | 3.2 | 3.6 | 4.5 | 5.9 |

| Mania and bipolar disorder | 1.3 | 1.4 | 1 | 0.9 |

| Anxiety | 1.3 | 1.2 | 1.7 | 2.3 |

| Psychotic disorders | 7.1 | 6.6 | 6.6 | 6.8 |

| Other mental disorders | 2.7 | 4 | 4.6 | 4.7 |

Incidence of disability retirement based on mental disorders for under-35-year-old women / 10,000 person-years

| Diagnosis | 2007 | 2011 | 2015 | 2019 |

|---|---|---|---|---|

| Total | 15.4 | 16.1 | 19.3 | 23.1 |

| Depression | 5.7 | 5.9 | 7.7 | 10.6 |

| Mania and bipolar disorder | 2 | 2 | 1.9 | 2.5 |

| Anxiety | 1.3 | 1.8 | 2.4 | 3.1 |

| Psychotic disorders | 4.3 | 4 | 4 | 3.7 |

| Other mental disorders | 2 | 2.3 | 3.2 | 3.3 |

Publications:

- Koskenvuo et al. 2021. Selvitys kuntoutustukea saaneista. Aiempi tutkimus ja rekisteriseuranta vuonna 2015 kuntoutustuen aloittaneista [Survey on recipients of the fixed-term disability pension. Previous study and register follow-up of new recipients of the fixed-term disability pension in 2015] (Helda)

- Laaksonen 2020. Work resumption after a fixed-term disability pension: changes over time during a period of decreasing incidence of disability retirement (Julkari)

- Laaksonen et al. 2021. The incidence of disability retirement due to mental disorders has increased among young people but decreased in older age groups (Summary in English, Julkari)

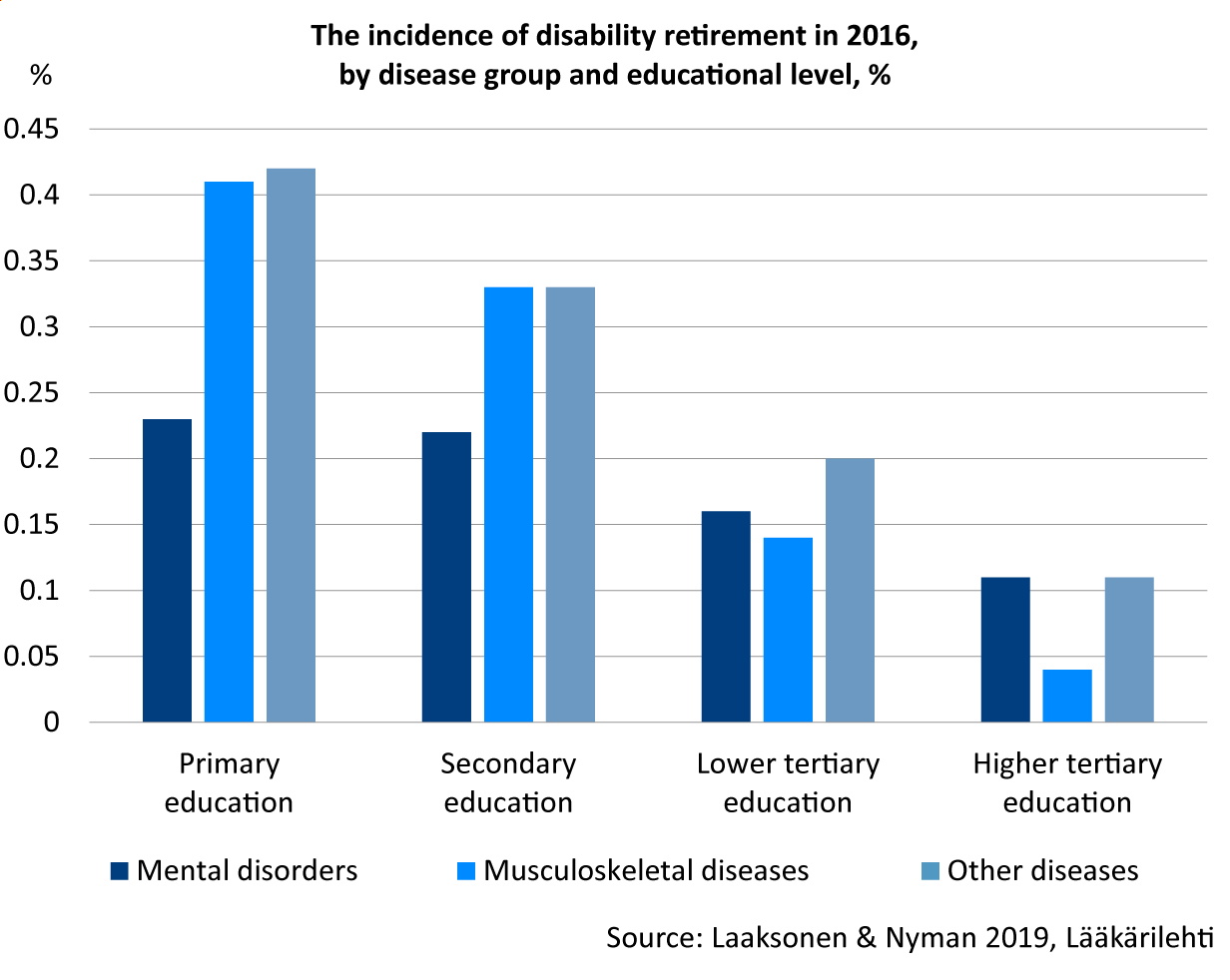

The incidence of disability retirement is not even in all socioeconomic classes. Manual workers run a clearly higher risk of disability retirement than upper non-manual employees. A low educational level and a low income are also associated with a higher risk of disability retirement. The higher risk of disability retirement of the lower socioeconomic classes is largely explained by physically more strenuous working conditions. The health of manual workers also tends to be poorer than that of upper non-manual employees.

However, in the 2000s, socioeconomic differences in disability retirement have narrowed as retirement has decreased more in the lower than in the upper social classes. Socioeconomic differences in disability retirement are larger in disability retirements caused by somatic illnesses than those caused by mental disorders.

There are also occupational differences in disability retirement. Disability retirement is common in many blue-collar occupations, such as gardeners, replacement workers, cleaners, construction finishing workers and school assistants, as well as in many ancillary occupations in health care, such as practical nurses.

Publications:

- Kiander et al. 2021. Työkyvyttömyyden kehitys ja eläkkeiden rahoitus (Julkari)

- Laaksonen & Nyman 2019. Retirement due to disability has decreased among the unemployed and older Finns of working age (Summary in English, Julkari)

- Polvinen 2016. Socioeconomic status and disability retirement in Finland. Causes, changes over time and mortality (Julkari)

- Polvinen et al. 2013. Socioeconomic differences in disability retirement in Finland: The contribution of ill-health, health behaviours and working conditions (Scandinavian Journal of Public Health)

- Polvinen et al. 2014. The contribution of major diagnostic causes to socioeconomic differences in disability retirement (Scandinavian Journal of Work, Environment & Health)

- Polvinen et al. 2016. Socioeconomic Differences in Cause-Specific Disability Retirement in Finland, 1988 to 2009 (Julkari)

In 2023, 37 per cent of all disability pension applications were rejected. Most often applications are rejected because the applicant is not considered disabled enough or because the disability has not continued long enough. Granting a disability pension requires an uninterrupted period of disability that spans at least one year.

The share of rejected disability pension applications has increased in the 2000s. Changes in the background factors of disability retirement applicants do not explain this growth. However, the number of disability pension applications due to mental disorders has increased, and the share of rejected disability pension applications based on mental disorders is higher than average.

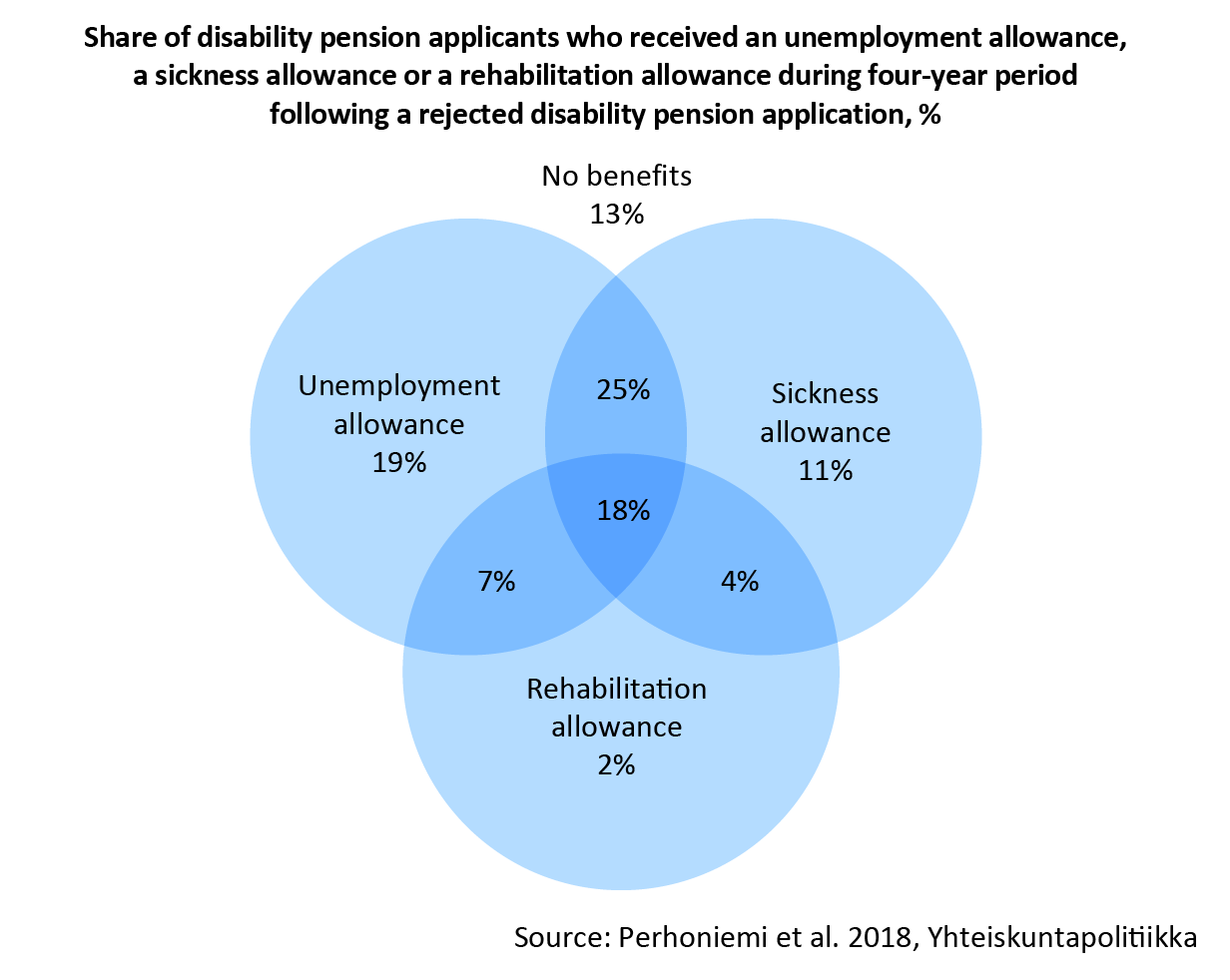

A large share of those whose disability pension applications have been rejected end up on a disability pension over the following years. Receiving an unemployment or sickness allowance is also common after a rejected disability pension application. Many rejected applicants have varied sources of income in the years following the rejection. This indicates that they typically suffer from some type of problem relating to work ability even if their disability pension application was rejected.

Publications:

- Laaksonen 2020. Retirement on disability pension: trends, current situation, future outlook (Summary in English, Julkari)

- Laaksonen & Nyman 2018. Työkyvyttömyyseläkkeiden hylkäysosuuden kasvu 2007–2016 [Growth in share of rejected disability pensions 2007–2016] (Julkari)

- Laaksonen et al. 2017. Labor market position after a rejection of a disability pension application: a register-based cohort study (Julkari)

- Perhoniemi et al. 2018. What next after a rejected disability pension application? Unemployment, sickness and rehabilitation benefits and new disability pension decisions in a four-year follow-up (Summary in English, Julkari)

- Perhoniemi et al. 2019. Determinants of disability pension applications and awarded disability pensions in Finland, 2009 and 2014 (Scandinavian Journal of Public Health)

- Perhoniemi et al. 2019. Sources of income following a rejected disability pension application: a sequence analysis study (Disability & Rehabilitation)

A person may be granted a disability pension if their ability to work has been reduced without interruptions for at least one year. As a rule, loss of income for shorter periods of disability is compensated with a sickness allowance. The longer the sickness allowance has continued, the higher the risk of disability retirement.

During the period of the daily sickness allowance, efforts are made to determine the need for rehabilitation and support a return to work. 70 per cent of those who have received a sickness allowance for the maximum limit of one year retire directly on a disability pension. Of the remaining 30 per cent, more than half apply for a disability pension but are not granted one at this stage. Slightly less than half do not apply for a disability pension. They often return to paid employment. Those whose application for a disability pension is rejected often receive an unemployment benefit.

Unemployment and disability are often intertwined in many ways. It is common to receive unemployment benefits before retiring on a disability pension. Although rehabilitation is the primary alternative relative to disability retirement, vocational rehabilitation before disability retirement is rather rare and occurs mainly in the last few years before disability retirement.

Publications:

- Blomgren et al. 2023. Sairauspäivärahakausien tarkistuspisteet : Kuntoutuksen ja työhön paluun toteutuminen [Checkpoints for Sickness Allowance Periods Implementation of Rehabilitation and Return to Work] (Julkaisuarkisto Valto)

- Laaksonen et al. 2014. Sickness allowance, rehabilitation and unemployment history of disability retirees (Summary in English, Julkari)

- Laaksonen et al. 2016. Sickness allowance trajectories preceding disability retirement: a register-based retrospective study (Julkari)

- Laaksonen et al. 2023. Impact of a Finnish reform adding new sickness absence checkpoints on rehabilitation and labor market outcomes: an interrupted time series analysis (Scandinavian Journal of Work, Environment & Health)

- Perhoniemi et al. 2021. Mitä sairauspäivärahan enimmäisajan täytyttyä? Toimeentulon lähteet kahden vuoden seurannassa [What next after the maximum period of the sickness allowance is up? Sources of income in a two-year follow-up] (Sosiaalilääketieteellinen aikakauslehti)

- Salonen et al. 2020. From long-term sickness absence to disability retirement: diagnostic and occupational class differences within the working-age Finnish population (BMC Public Health)

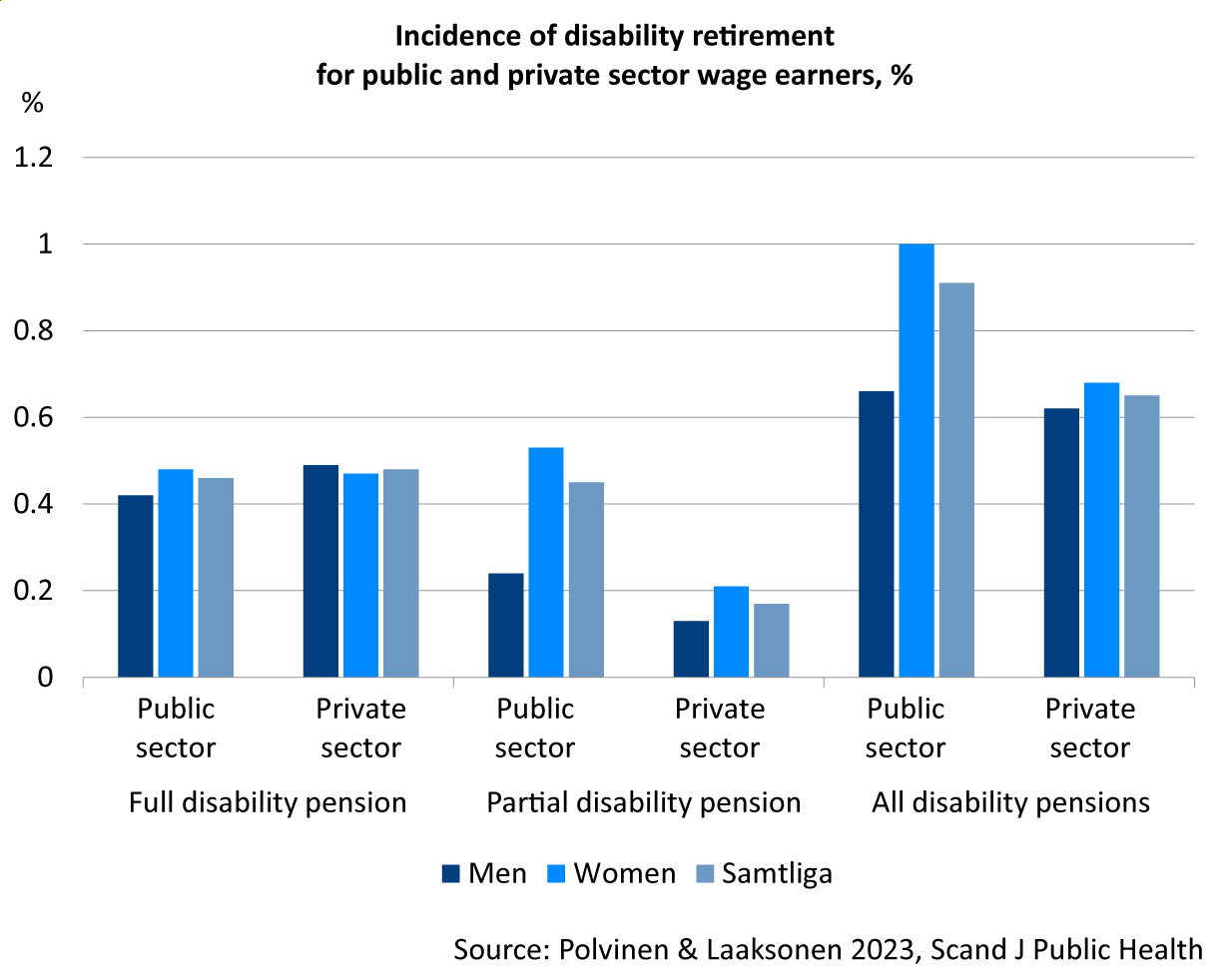

Disability retirement is more common in the public than the private sector. In particular, the incidence of partial disability retirement is higher in the public than the private sector, while the difference in the incidence of full disability retirement between the sectors is small.

The differences in age and gender structure of public and private sector employees partly explain why the incidence is higher in the public sector. Public sector employees are older than private sector employees, and most public sector employees are women.

Sector differences in occupational structures, on the other hand, do not explain the differences in incidence. There are also differences in pension financing and the definition of disability, which may partly explain the higher incidence of disability retirement in the public sector.

Publications:

- Laaksonen 2020. Retirement on disability pension: trends, current situation, future outlook (Summary in English, Julkari)

- Polvinen 2021. Differences in disability retirement between municipal and private sector employees (Abstract in English, Julkari)

- Polvinen & Laaksonen 2023. The contribution of age, gender and occupational group to the higher risk of disability retirement among Finnish public sector employees (Julkari)

Supporting work ability and continuing at work

Supporting continued working through vocational rehabilitation has increased in recent decades. During a period of a daily sickness allowance or a fixed-term disability pension (also called a cash rehabilitation allowance), efforts are made to facilitate a return to work through treatment or rehabilitation, even when the disability is prolonged.

A person with a reduced work ability is entitled to vocational rehabilitation financed by an earnings-related pension provider if it is established that the person is likely to retire on a disability pension soon.

As a rule, vocational rehabilitation takes place at the employee’s workplace, which often means work try-outs or new tasks at one’s own place of work. If rehabilitation at the workplace is not considered appropriate, the earnings-related pension provider can also finance training for another occupation.

Vocational rehabilitation arranged by earnings-related pension providers is clearly more frequent among women than men. The gender gap is particularly wide in rehabilitation received due to mental disorders. Receiving vocational rehabilitation is more common in larger companies. This may be explained by the fact that larger employers can more easily offer part-time work or other work arrangements than smaller employers.

Studies have not provided clear evidence of vocational rehabilitation significantly improving work ability or preventing retirement on a disability pension, at least not in the long term. As rehabilitation practices have been in transition in recent years, there is no research data available on the current situation regarding the impact of vocational rehabilitation.

Publications:

- Laaksonen et al. 2019. Individual- and company-level predictors of receiving vocational rehabilitation: a multilevel study of Finnish private sector workplaces (Julkari)

- Laaksonen et al. 2022. The impact of vocational rehabilitation on employment outcomes: A regression discontinuity approach (Julkari)

- Leinonen et al. 2019. The effectiveness of vocational rehabilitation on work participation : a propensity score matched analysis using nationwide register data (Scandinavian Journal of Work, Environment & Health)

- Leinonen et al. 2020. Effects of participation in vocational rehabilitation within the earnings-related pension scheme on disability retirement (Abstract in English, Duodecim)

How well rehabilitation processes work has been studied mainly through interviews with both rehabilitation professionals and rehabilitees. Key factors for successful rehabilitation include adequate support and monitoring throughout the entire process. Moreover, both professionals and rehabilitees consider the following as essential for the success of rehabilitation:

- careful planning and correct timing of rehabilitation,

- rehabilitee’s motivation,

- effective cooperation between the stakeholders involved in the rehabilitation,

- the rehabilitee’s possibilities to impact the rehabilitation process, and

- taking the rehabilitee’s individual needs into account.

According to studies, more attention should be paid to the period following work trials financed by pension providers and the subsequent employment status. A short work trial alone may not be sufficient to ensure a return to work.

Understanding the processes involved in returning to work and evaluating the outcomes of rehabilitation requires monitoring rehabilitees over a sufficiently long period.

According to studies, it is not meaningful to evaluate rehabilitation processes solely from the perspective of a single system, such as only from the perspective of rehabilitation under the earnings-related pension system. Many rehabilitees require services from various actors, either in turns or at the same time. There are challenges in the cooperation and division of responsibilities among different actors, and information does not always flow smoothly, for example, between the earnings-related pension system and employment services.

Publications:

- Liukko 2020. Decision practices for vocational rehabilitation under the earnings-related pension scheme and the effectiveness and impact of vocational rehabilitation (Summary in English, Julkari)

- Liukko 2021. Työeläkekuntoutuksen vaikuttavuuden kehittäminen ja työkykyajattelu : työeläkelaitosten asiantuntijoiden haastatteluihin perustuva tutkimus [Developing impact of vocational rehabilitation and thoughts on working capacity: study based on interviews with experts from earnings-related pension providers] (Julkari)

- Liukko & Kuuva 2015. Cooperation in the management of working capacity problems (Summary in English, Julkari)

- Liukko & Kuuva 2016. Cooperation of return-to-work professionals : the challenges of multi-actor work disability management (Julkari)

- Liukko & Pasanen & Sten-Gahmberg 2023. Rehabilitees’ perspective on rehabilitation planning under the

earnings-related pension system (Summary in English, Julkari) - Liukko & Pasanen & Sten-Gahmberg 2024. Kuntoutujien näkemyksiä työeläkekuntoutuksen hyödyistä ja kehittämiskohteista: Työkokeiluun osallistuneiden kuntoutujien haastatteluihin perustuva tutkimus (Summary in English, Julkari)

- Liukko & Pasanen & Sten-Gahmberg 2024. Rehabilitees’ perspective on the benefits and development areas of rehabilitation under the earnings-related pension system (Summary in English, Julkari)

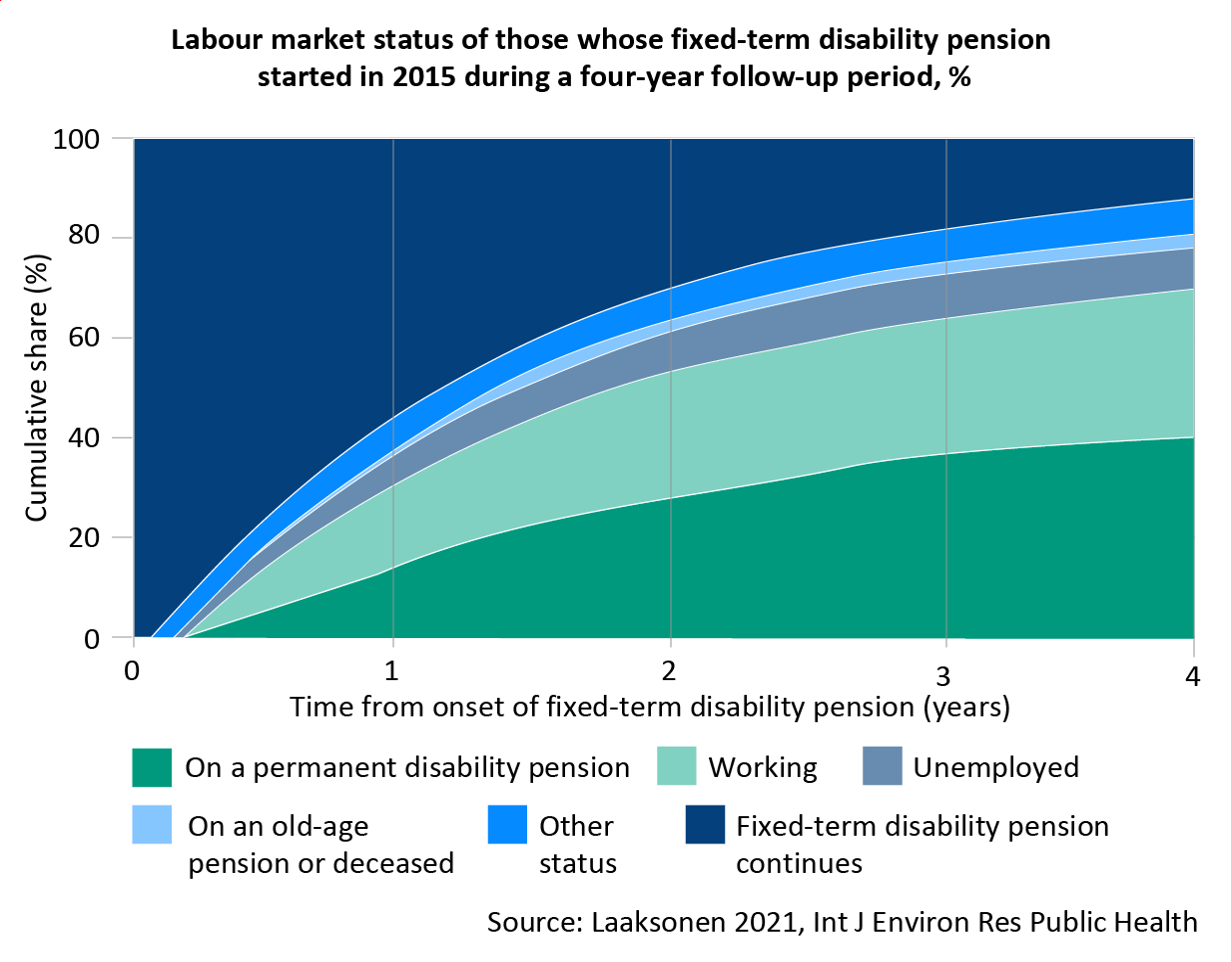

In Finland, a disability pension may be awarded either as a fixed-term disability pension or as a permanent disability pension. The disability pension is granted as a fixed-term rehabilitation benefit if it is possible that the employee’s work ability can be restored after the onset of the benefit. The share of fixed-term disability pensions of all new disability pensions has increased. Currently, clearly more than half of all new disability pensions begin as a fixed-term disability benefit.

A large share of fixed-term disability pensions is later converted into permanent pensions. Forty one per cent of all fixed-term disability pensions that started in 2015 were converted into permanent disability pensions within four years. 30 per cent returned to work during the same period.

In recent years, an increasing share of persons receiving a fixed-term disability pension has returned to work while a decreasing share has transferred to a permanent disability pension. In addition, an increasingly higher share of fixed-term disability pensions continues for more than four years.

There are differences between disease categories in the return to work from a fixed-term disability pension. The return to work of those suffering from mental disorders, in particular, has been weak. Although retirement on a permanent disability pension occurs less often than before, return to work has not increased.

Publications:

- Koskenvuo et al. 2021.: Selvitys kuntoutustukea saaneista : Aiempi tutkimus ja rekisteriseuranta vuonna 2015 kuntoutustuen aloittaneista [Review on fixed-term disability pension recipients: Previous study and register follow-up on new recipients of the fixed-term disability pension in 2015] (Helda)

- Laaksonen 2021. Work Resumption after a Fixed-Term Disability Pension: Changes over Time during a Period of Decreasing Incidence of Disability Retirement (Julkari)

- Laaksonen & Gould 2014. Return to work after temporary disability pension in Finland (Julkari)

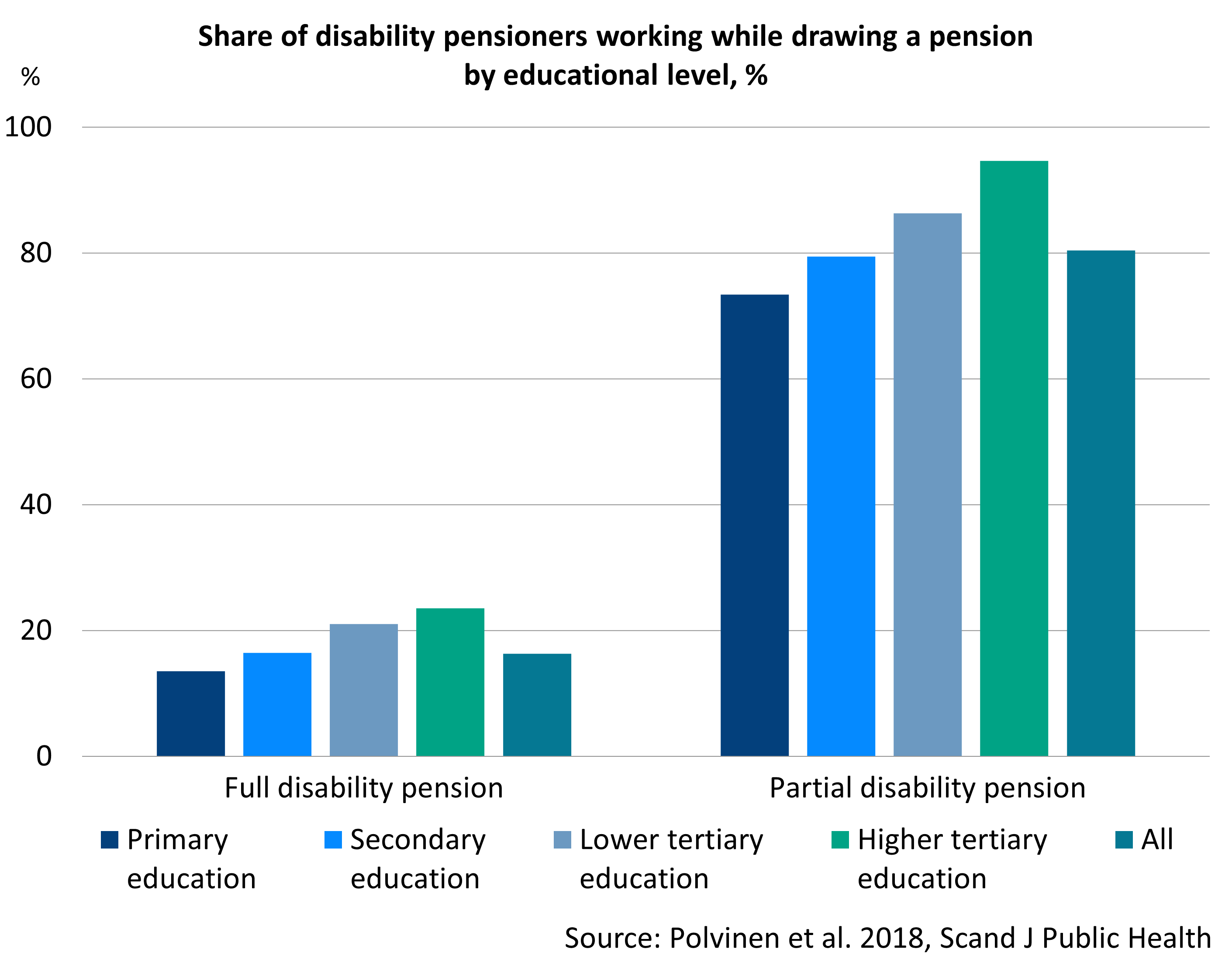

The share of partial disability pensions of all new disability pensions has increased in recent years. Currently nearly every third earnings-related disability pension is granted as a partial pension. Most (around 80%) partial disability pension recipients continue working while drawing the pension. The average duration of a partial disability pension is just under three years, and most recipients work throughout the time they receive the pension.

Partial disability pension recipients differ from full disability pension recipients in many respects. Nearly 70 per cent of partial disability pension recipients are women, and many receive the pension due to musculoskeletal diseases.

Nearly half of all partial disability pension recipients are public sector employees, one-third are private sector employees, and about 5 per cent are self-employed. Less than one-fifth were unemployed before starting their partial disability pension. Most recipients have at least an intermediate educational level and one-third have completed higher education.

There are also income differences among disability pension recipients. Those who continue working while receiving a disability pension have higher net incomes than others. Additionally, disability pension recipients who come from white-collar jobs or have worked as self-employed persons tend to have higher average income levels compared to others.

A transition from partial disability retirement to full disability retirement is relatively rare. During a four-year follow-up period, one third of the 20–58-year-olds who retired on a partial disability pension transitioned to a full disability pension while half continued drawing a partial disability pension. The rest either returned to work or became unemployed.

Probability of transition from partial DP to full DP and to other states during follow-up, %

| Diagnosis | Continued on partial DP | Moved to full DP | Moved to employment | Moved to unemployment | Moved to old-age pension | Other |

|---|---|---|---|---|---|---|

| All | 52 | 33 | 9 | 3 | 1 | 1 |

| Musculoskeletal diseases | 56 | 32 | 7 | 3 | 1 | 1 |

| Mental disorders | 41 | 37 | 16 | 5 | 1 | 0 |

| Other diseases | 53 | 33 | 8 | 3 | 1 | 3 |

Publications:

- Polvinen 2021. Työkyvyttömyyseläkkeelle siirtymisen erot kunta-alan ja yksityisen sektorin palkansaajilla [Differences in disability retirement between municipal sector and private sector wage earners] (Julkari)

- Polvinen & Laaksonen 2022. Determinants of transition from partial to full disability pension: a register study from Finland (Julkari)

- Polvinen & Rantala & Laaksonen 2023. Osatyökyvyttömyyseläkeläisten työssäkäynti ja ansiotyön merkitys toimeentulossa. [Employment and the importance of paid work for the income of partial disability pensioners]. (Työpoliittinen aikakauskirja)

- Polvinen et al. 2018. Working while on a disability pension in Finland: Association of diagnosis and financial factors to employment (Scandinavian Journal of Public Health)

Retirement on a disability pension does not necessarily mean stopping work altogether. While drawing a pension, disability pension recipients may earn up to 40 per cent and partial disability pension recipients up to 60 per cent of their established average pre-disability earnings.

When a disability benefit is granted in the form of a partial disability pension, the individual is considered to have some work ability left and to be able to continue working while drawing a partial disability pension. However, the individual is not required to work. Nearly 80 per cent of individuals on a partial disability pension work while drawing the pension.

The work ability of individuals on a full disability pension, on the other hand, is much weaker than that of individuals on a partial disability pension. Hence, working while drawing a full disability pension is less common. Of the recipients of a full disability pension, an ample 10 per cent work while drawing the pension.

Those with a higher education and those recently retired work more often while receiving a pension than those with a primary education and those who have received a full disability pension for a longer time.

Read more on Etk.fi:

Publications:

- Polvinen & Rantala & Laaksonen 2023. Osatyökyvyttömyyseläkeläisten työssäkäynti ja ansiotyön merkitys toimeentulossa. [Employment and the importance of paid work for the income of partial disability pensioners]. (Työpoliittinen aikakauskirja)

- Polvinen et al. 2018. Working while on a disability pension in Finland: Association of diagnosis and financial factors to employment (Scandinavian Journal of Public Health)

In 2023, the average total pension of all disability pensioners was approximately 1,276 euros per month. This is clearly less than what old-age pensioners received. Disability pensioners often have a meagre income.

Disability pensions have decreased slightly on average in the 2000s. This is because disability pensioners are younger than before and have retired on a disability pension at a younger age than before.

The share of disability pensioners receiving an earnings-related pension has decreased while the share of those receiving only a national pension has increased. The guarantee pension that was introduced in 2011 has improved the situation for many disability pensioners since the proportion of disability pensioners who receive this pension benefit is large.

The income of disability pensioners remains lower than average also in old-age retirement since the disability pension is converted into an old-age pension of the same amount when the individual reaches their old-age retirement age. Old-age pensioners with previous disability pension experience more economic difficulties in covering, for example, housing and health care costs than old-age pensioners without a previous disability pension.

Publications:

- Kuivalainen et al. 2022. Pensions and pensioners’ economic welfare 1995–2015

- Polvinen et al. 2019. Explanations for economic difficulties among old-age pensioners previously on disability pension (European Journal of Public Health)

- Polvinen ym. 2025. Over-55-year-old current and former disability

pensioners’ experiences of financial well-being (Summary in English, Julkari) - Rantala & Laaksonen 2022. Ovatko työkyvyttömyyseläkeläisten eläkkeet pienentyneet? (Have the pensions of disability pension recipients become smaller?]

- Rantala et al. 2017. The economic welfare of disability pensioners in the 2000s (Summary in English, Julkari)

- Rantala et al. 2024. Työkyvyttömyyseläkkeelle siirtyneiden tulot ja tulorakenne vuonna 2020 (Julkari)