Overview of pensions

Earnings-related pensions, the national pension and guarantee pension ensure an income in old age and in case of disability and the death of a family breadwinner. Pensions are also paid from, for example, the statutory motor liability and workers’ compensation insurance schemes. The overall pension may include private, voluntary pensions or occupational pensions paid for by the employer. Statutory pensions are taxable income.

Earnings-related pensions based on wage

The aim of earnings-related pensions is to ensure that the income level during working life continues at a reasonable level also at and throughout retirement.

Earnings-related pensions accrue for all work insured under the earnings-related pension acts as of age 17 for wage-earners and as of age 18 for the self-employed. The retirement income of a person with an average working life thus mainly consists of earnings-related pensions.

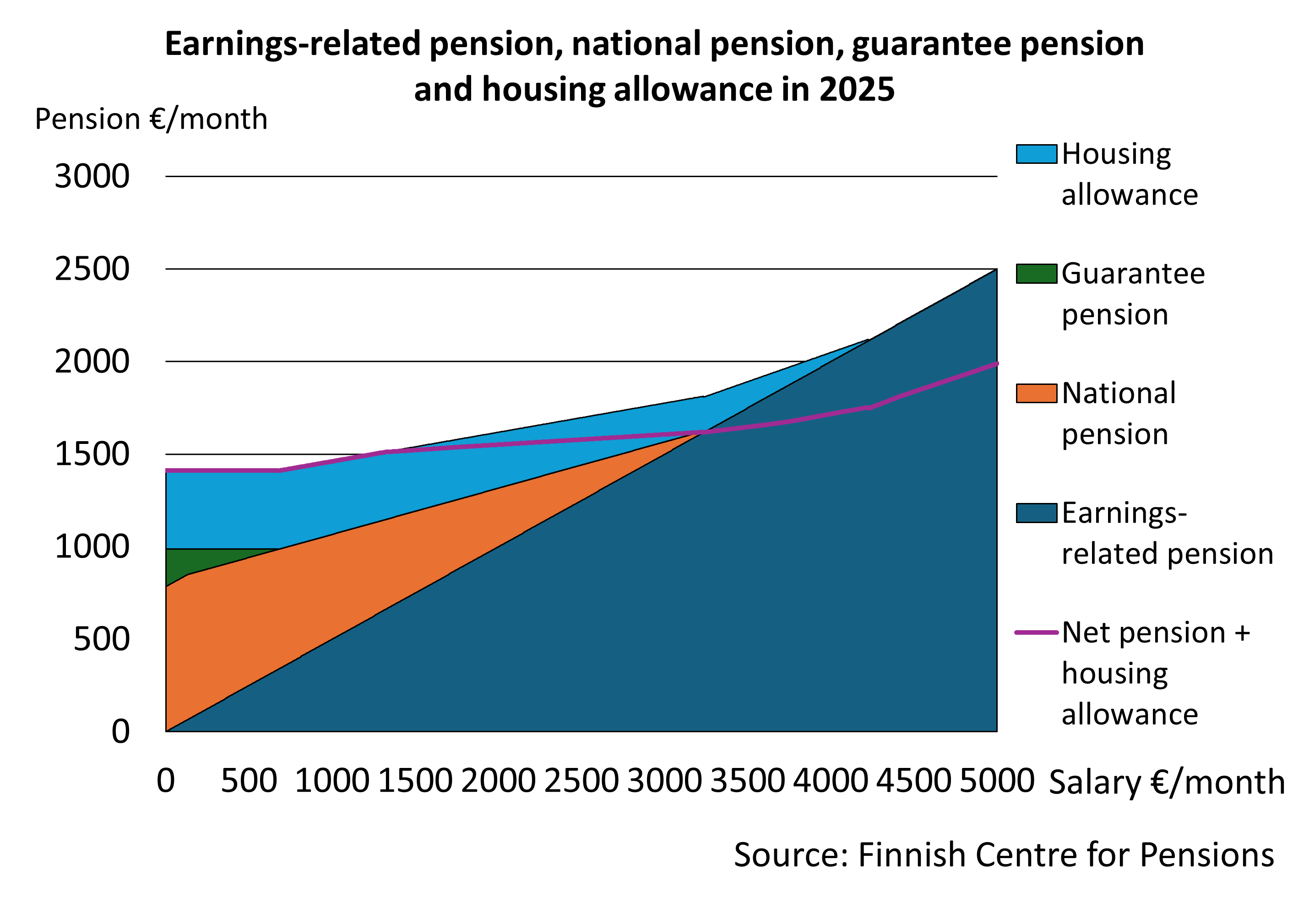

National pension and guarantee pension provide minimum pension

The national pension and the guarantee pension ensure a minimum income for persons who have only a small or no earnings-related pension due to a short working life or low earnings. Under certain conditions, all persons resident in Finland are entitled to the national pension and the guarantee pension.

Other income transfers paid by Kela, such as the housing allowance for pensioners and the pensioner’s care allowance, also improve the income of low-income pensioners.

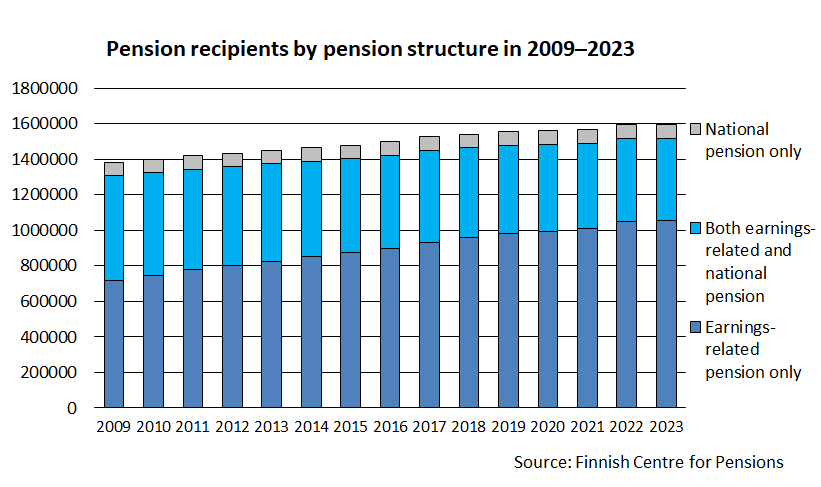

Nearly all pensioners receive an earnings-related pension

The gradually maturing earnings-related pension system provides a considerable part of pensions. At year-end 2023, around 66 per cent of persons residing in Finland received a pension only under the earnings-related pension system.

Around 29 per cent received a pension under both the national pension and the earnings-related pension systems, and five per cent received only a national pension. Persons residing in Finland and receiving a pension numbered around 1,598,000 at year-end 2023. Around 1,568,000 persons received a pension in one’s own right (excl. the survivors’ pension).

Additional income from supplementary voluntary pensions

Occupational pensions financed by employer and privately funded supplementary pensions complement income in retirement. From the point of view of overall pension provision, supplementary pensions pay a minor role. Statutory pensions cover about 94 per cent of total pension provision.

Taxation determines the final amount

The final pension amount consists of the pension in hand after taxation and social security contributions. The taxation of statutory pensions is determined mainly in the same way as the taxation of other income. However, the tax and contribution burden on pensions and wage income is different because of differences in tax deductions and social insurance contributions.