Mind the gap! Educational differences in average effective ages of retirement

The Finnish Centre for Pensions recently reported that Finns continue to retire at a later age. In line with the rising eligibility age for the old-age pension, the average retirement age went up three months in 2019 compared to 2018. This can be seen as a successful outcome of a series of reforms in the Finnish pension system and labour market and is good news in many ways. However, figures of rising retirement ages tend to hide socioeconomic inequalities in extending working lives.

Using a new way to calculate retirement ages by levels of education with European comparative data shows that especially lower-educated older workers continue to exit the labour force at a younger age than those with a higher education. The educational gap in retirement ages seems to have been closing somewhat recently in Finland and neighbouring countries. The question remains how the current COVID-19 pandemic will affect these trends in the coming years.

To compare countries and observe changes in actual retirement across time, international organisations such as the OECD and European Commission usually look at average effective ages of retirement (or in more precise terms: the average or effective exit age, see here for explanation). Yet, these statistics are only available for the population as a whole and as separated by gender. For methodological reasons it is not possible to calculate the effective exit ages for individual characteristics that change across time, e.g. occupation, industry or income bracket, although the differences between groups based on these characteristics may be large and should be of interest to policymakers.

Level of education, however, can be assumed to remain relative stable during adult working life and is a relevant indicator of socioeconomic status. The European Labour Force Survey (EU-LFS), the same data that are used by the OECD and EU to calculate effective exit ages, has information on broad levels of education (low, intermediate and high) for more recent years. I used these data to calculate the effective exit ages by educational level for several European countries between 2003 and 2019. In broad lines, the same methods can be applied as the OECD and EU use in their reports (Carone, 2005; Scherer, 2002).

Finland: Educational gap prevails but some signs of improvement for the lower educated

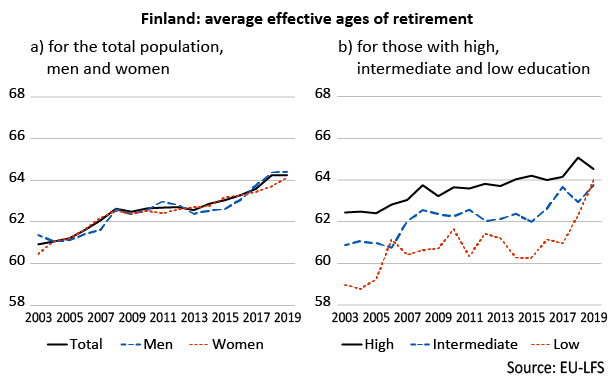

Figure 1 shows the average effective exit ages for the total population as well as for men and women separately (1a) and as divided by broad categories of education levels (1b). Panel a displays the overall rising trend in retirement ages between 2003 and 2019. Although there was some stagnation following the financial and economic crisis of 2008, the average effective exit age of the total population rose from 60.9 in 2003 to 64.3 in 2019. Note that estimated ages are somewhat higher than Finnish Centre for Pension’s latest calculations based on their own register data and different methods. The trend, however, is the same. There are no considerable differences between men and women’s retirement ages.

A similar upward trend can be observed among the three education levels, yet the gap between them was relatively large during most of the years (1b). Higher educated tended to retire between one and two years later than intermediate educated, while the retirement age gap between the higher and lower educated was around two to four years. In recent years, effective retirement ages of the intermediate and lower educated have started to rise faster and have converged to the retirement ages of higher educated. However, it is still too early to conclude whether this is trend can be sustained.

Finland in international comparison

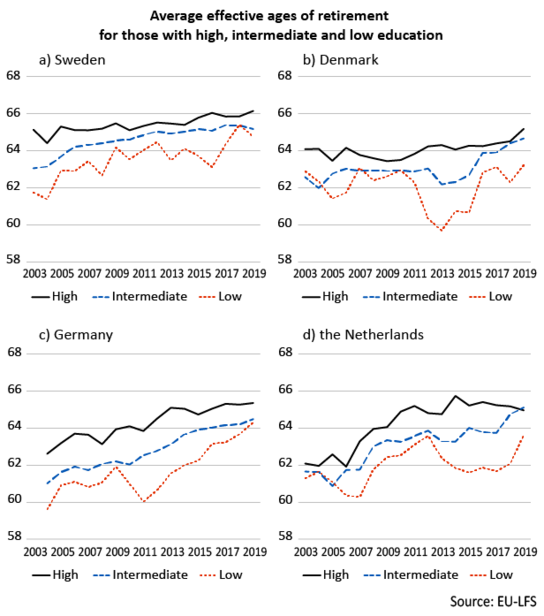

When comparing Finland with some of its Nordic neighbours and countries on the European continent, it is clear that the educational gap in retirement ages exists elsewhere as well (Figure 2). In Sweden (2a) average effective exit ages have been among the highest in Europe and the gap between education levels relatively small. In Sweden and Denmark (2b) retirement ages have not risen as much as in Germany (2c) and the Netherlands during the past decade.

Similar to Finland, there has been some degree of convergence in exit ages in these four countries during the most recent years. However, retirement ages of the lower educated at a certain point dropped before starting to rise again, increasing the educational gap for several years: in Germany after 2009, in Denmark after 2010, and in Sweden and the Netherlands after 2012. Although based on these observations we cannot be sure of the reasons, it is not unlikely that this temporarily increased disparity was related to the financial and economic crisis that started in 2008.

Following the Corona-pandemic: Will disparities increase again?

Economic crises tend to hit younger workers first. They are more often employed on temporary contracts and enjoy less protection in the labour market. Older workers initially might stay relatively safe. However, the effect of the crisis on their employment can come later, even when the economy is already recovering. After the previous economic crisis, older unemployed in many countries had difficulties finding new employment, making retirement the only or most attractive alternative (Axelrad, Sabbath, & Hawkins, 2018; Van Horn, Corre, & Heidkamp, 2011). Figure 2 shows that this might be especially the case for those with lower education.

Now that the economy is entering recession due to the Covid-19 pandemic and unemployment is likely to rise, it is of course important to first think how to help the ones that lose their jobs now. But it is also worth anticipating the near future and consider how to sustain the trend of rising retirement ages by focusing on measures that promote longer working lives of the lower educated older workers in particular.

References

Axelrad, H., Sabbath, E. L., & Hawkins, S. S. (2018). The 2008–2009 Great Recession and employment outcomes among older workers. European Journal of Ageing, 15(1), 35-45.

Carone, G. (2005). Long-term labour force projections for the 25 EU Member States: A set of data for assessing the economic impact of ageing. EC Directorate for Economic and Financial Affairs, Economic Papers, No. 235.

Finnish Centre for Pensions (2020). Pension reform extends working lives. Press release 29.10.2020

Scherer, P. (2002). Age of withdrawal from the labour force in OECD countries. OECD Labour Market and Social Policy Occasional Papers, No. 49.

Van Horn, C. E., Corre, N., & Heidkamp, M. (2011). Older workers, the great recession, and the impact of long-term unemployment. Public Policy & Aging Report, 21(1), 29-33.