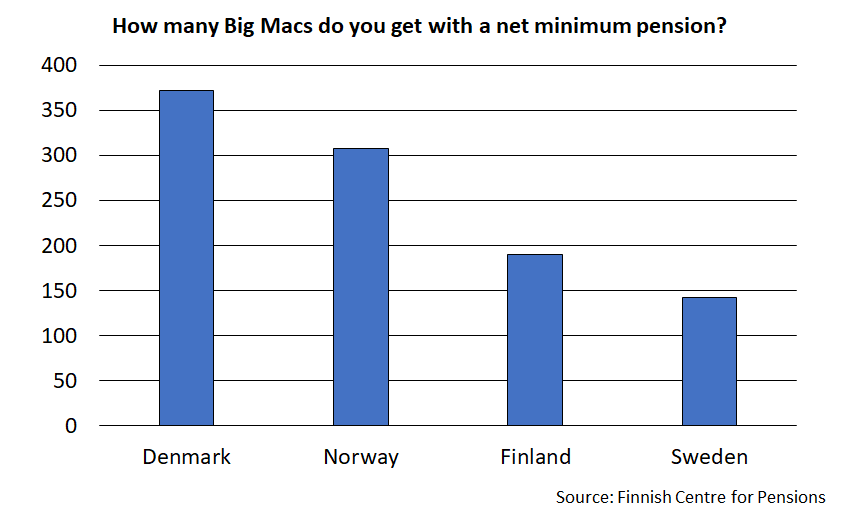

How many Big Macs can you buy with your net minimum monthly pension in the Nordic countries?

The minimum net pension in Norway is the highest in all Nordic countries, but the purchasing power is the largest in Denmark. The Danish can buy a Big Mac each day of the year with one month's minimum pension. The Finns have to settle for a Big Mac every second day. The Swedes get the lowest number of Big Macs with their monthly minimum pension.

When comparing the monthly minimum pension level, the four Nordic countries are divided into two groups. Finland and Sweden fall clearly behind Denmark and Norway. The monthly minimum pension in the latter two countries are actually on the level of the average pension in Finland.

The highest gross minimum pension is in Denmark but so is the tax rate. The highest net amount is hereby found in Norway. However, due to the high Norwegian price levels, the purchasing power of Norwegian pensions is reduced, making the Danish minimum monthly pension the clear winner of our comparison.

Bic Mac index allows for comparison of purchasing power of pensions

The Big Mac index, created by The Economist, is an excellent tool for making purchasing-power parity (PPP) comparisons. Using the price information of a globally standardised product – the Big Mac hamburger – we can make the purchasing power of the currencies of different countries comparable.

The index and the Figure below show how many Big Macs one can buy with the net monthly minimum pension in each country. A similar comparison of average pensions would also be interesting but more challenging since the ‘beef’, that is, comprehensive statistics on earnings-related pension, is missing.

In this comparison, minimum pension refers to a monthly pension granted in the country in question to a single person based on residence. Housing allowances are not included in the comparison.

Minimum monthly pension in Denmark and Norway more than €1,500

In Denmark, the maximum monthly minimum pension (before tax) is more than 2,000 euros. It consists of the basic national pension (€800), paid to all pension recipients, an income-tested additional pension (€990) and a lump sum supplementary pension benefit (ældrecheck, €2,500), paid at the beginning of each year. The last two are reduced by the pension recipient’s and the spouse’s earnings as well as pension and capital income.

In Norway, the maximum amount of the guarantee pension, from which any earnings-related pension may be deducted, is 1,600 euros. After the pension income deduction granted in taxation, there is nothing taxable left of the minimum pension. In Denmark, a full national pension and a lump-sum supplementary component is taxed at a rate of 27 per cent. The pension left in hand is around 1,500 euros.

Guarantee pension in Finland and Sweden 840 euros

The guarantee pension in Finland and Sweden (guaranteed pension) are both around 840 euros. In Finland, no taxes are left to be deducted once the pension deduction has been made to the guarantee pension. In Sweden, taxation reduces the monthly pension amount by around one hundred euros.

In both countries, the amount of the guarantee pension was adjusted in 2020 to improve the income of low-income pensioners. In Sweden, the largest measures concerned the housing benefit that is excluded from this comparison.

Sweden’s “first-of-May one hundred”

In 2018, the pension level and its improvement were highlighted in both Finland and Sweden in the 1st-of-May speeches of the two countries’ prime ministers. In Finland and Sweden alike, the “first-of-May one hundred” caused much debate.

The Swedes will get their one hundred starting from September 2021 when the earnings-related pensions of low-income pension recipients with a long working history will be increased with a separate earnings-related pension supplement. The increase is funded with tax funds. Pension recipients whose earnings-related pension amounts to 900–1,700 euros will get an increase of a maximum of 60 euros to their monthly pension.

Discussions of impact of incentives connects the Nordic countries

The increases to the guaranteed pension and the housing allowance made in Sweden have raised minimum pensions to the same level as the earnings-related pension for a full working life in low-income fields. This has raised discussions on pensions’ weakening incentives for working. The intention is to dismantle the incentive trap by increasing the gap between earnings-related pensions and national pensions (“respektavstånd”) also by raising the contribution of the contribution-based earnings-related pension.

In Denmark, the criticism focuses on the consolidation of supplementary pension saving and the additional component of the national pension which reduces the national pension amount. This has made Danish self-employed people less willing to take out supplementary pension insurance to compensate for the lack in earnings-related pensions for self-employed persons.

In Finland, the challenges relating to incentives are also most clearly visible in pension solutions for the self-employed. Some of the self-employed find earnings-related pension insurance uneconomical when assessed relative to the level of the guarantee pension.

In the Nordic countries, pension systems have been successfully reformed, promoting the role of working or, in other words, strengthening the correlation between contributions and benefits. In Denmark, the role of earnings-related occupational pensions grows. Increasingly fewer people get the supplementary component of the national pension since a growing number of people earn a labour market pension throughout their working life. This does not, however, make it less important to secure the economic welfare of low-income pensioners and to measure the levels of minimum pensions in the different countries through various indicators.

Great job, Mika, with another interesting and creative Nordic comparison! This is a hotly debated topic in all our countries!

For your information: The guarantee pension in Norway is the minimum pension for those born 1963 and after and is not the current minimum pension. For those born before 1954 the minimum pension for a single pensioner is NOK 208690 as of 1 May 2020 (“Særskilt sats enslige”):

https://www.nav.no/no/nav-og-samfunn/kontakt-nav/oversikt-over-satser/minste-pensjonsniva

You have to be at least of age 67 to qualify for the minimum pension. This is therefore the relevant amount for 2020.

(Those born 1954-1962 will receive a weighted average of Minste pensjonsnivå Særskilt sats enslige and Garantipensjonsnivå høy sats:

https://www.nav.no/no/nav-og-samfunn/kontakt-nav/oversikt-over-satser/garantipensjon_kap)

In addition the Norwegian parliament has decided to increase the minimum pension (only Særskilt sats enslige) with NOK 4000 per year from 1 May 2020 and NOK 5000 per year from 1 July 2020 in addition to the regular increase this year. None of these increases are included in the published amount of NOK 208690 (the first increase will have retroactive effect and will be paid out in June this year):

https://www.deterdinpensjon.no/2021/04/06/okt-minstepensjon-til-enslige-og-endret-arlig-regulering/

Thank you for your comment and additional information Ole! Indeed, I have used the amount of guarantee pension in my calculations. The amount of ‘Særskilt sats enslige’ provides 334 Big Macs instead of 308.