European comparison: How do low-income pensioners manage in everyday life?

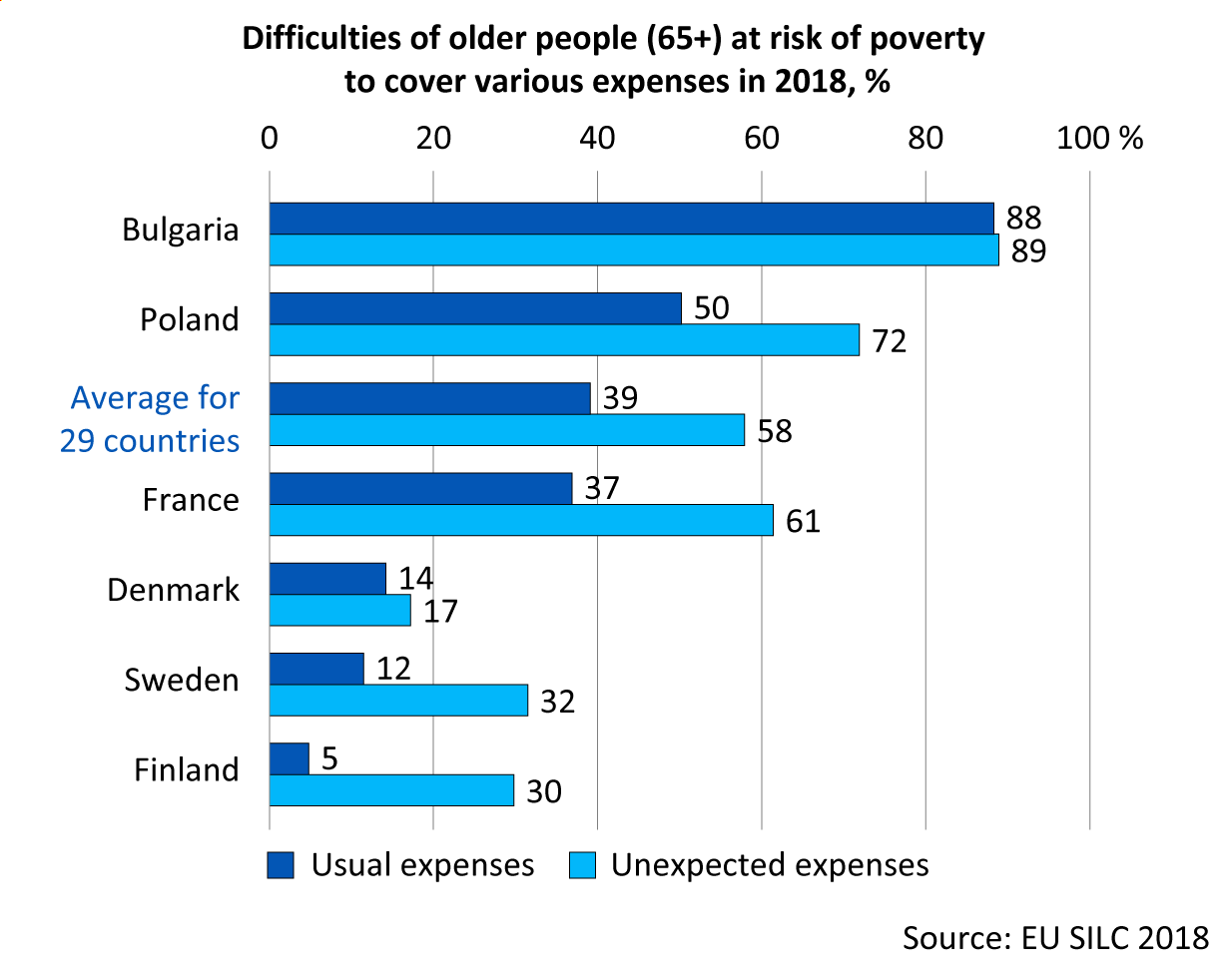

In Finland, people over 65 on low incomes struggle to pay for unexpected expenses, our new research shows. Paying for usual expenses is easier. Compared with other European countries, older people in Finland are much less likely to experience income problems.

The living conditions of older people are often considered in terms of low income, that is, living at risk of poverty. Income poverty makes it more difficult to make ends meet in many ways. In interviews, older people on low incomes describe their livelihoods as being based on very careful planning of their spending.

To avoid going into debt due to unexpected expenses, such as broken appliances or medical bills, it is essential to have savings. Our aim was to gain a comprehensive understanding of how living in relative poverty impacts the daily lives of older people.

Based on the 2018 EU Statistics on Income and Living Conditions (EU-SILC), we analysed the frequency of difficulty experienced by individuals aged 65 and over, who are at risk of poverty, in paying for their usual expenses and larger unexpected expenses. This indicator serves as a measure of the individual’s access to savings.

We used the 2018 EU Statistics on Income and Living Conditions (EU-SILC) to find out how often people aged 65 and over who are at risk of poverty find it difficult or very difficult to pay for their usual expenses. We also looked at how often they were unable to meet larger unexpected expenses. This last question shows whether the person has access to savings.

In general, the results describe the income difficulties of those below and above the at-risk-of-poverty threshold. The analysis does not take into account how close or far from the at-risk-of-poverty threshold pensioners’ incomes are.

Low-income older people experience hardships when facing unexpected expenses

In Finland, the difficulties faced by low-income people are particularly visible in the form of difficulties in paying for unexpected expenses. Covering usual expenses is easier (Graph 1).

Compared with older people in other European countries, the gap in the Finns’ ability to cover these different types of expenditure is one of the largest. Overall, however, difficulties in making ends meet are less common in Finland than in many other countries. In Eastern Europe, there is often not enough money to cover usual and unexpected expenses.

Higher earners also face income problems – large differences related to income level in Central European countries

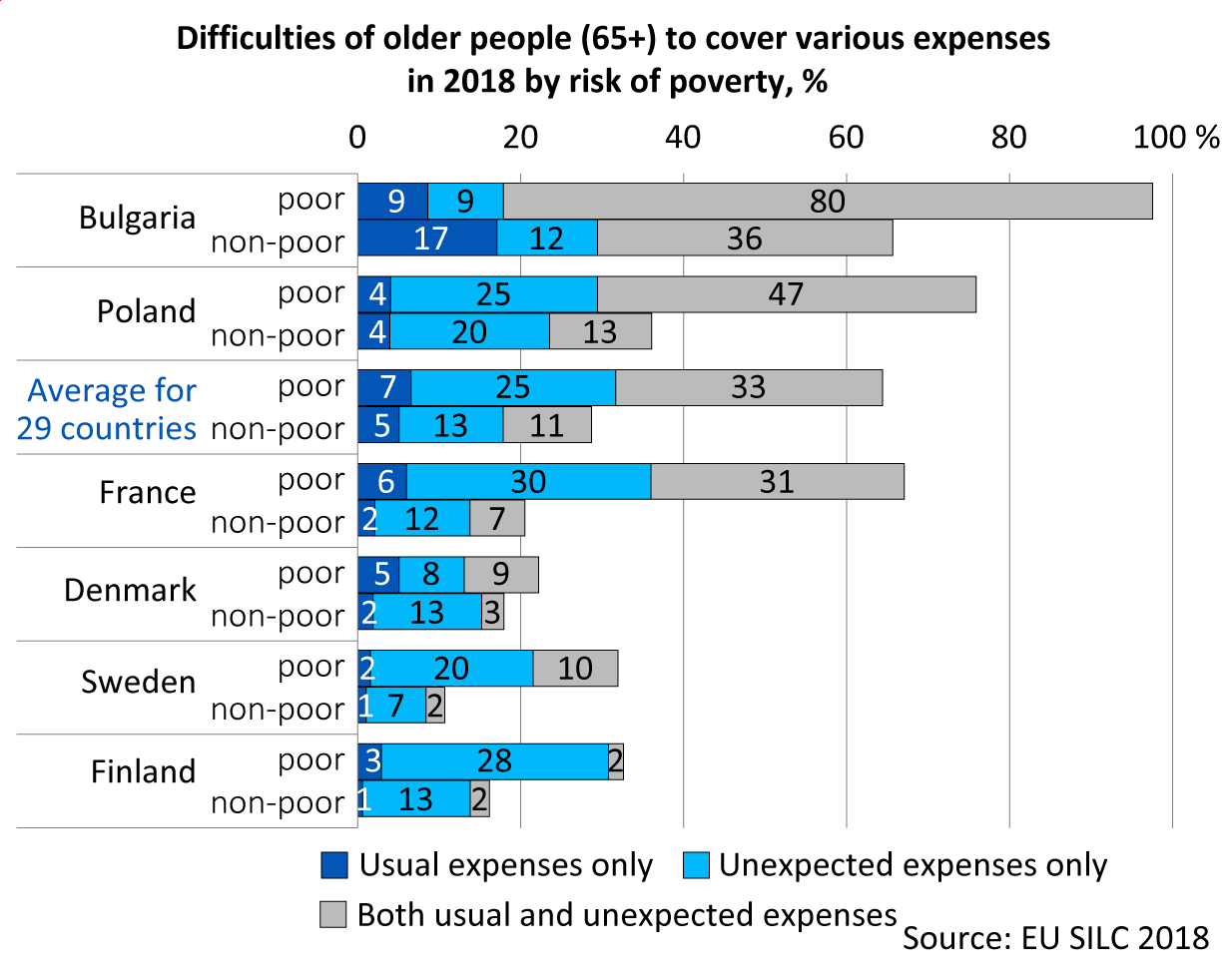

Income difficulties are not limited to those at risk of poverty (Graph 2). In all countries, those above the at-risk-of poverty threshold also face difficulties in making ends meet.

In Finland, the proportion of people who have problems paying for either usual expenses or both usual and unexpected expenses is equally low on both sides of the at-risk-of poverty threshold. Looking at problems with unexpected expenses only, those with higher incomes – those above the at-risk-of poverty threshold – are much less likely to have problems than those with lower incomes. This suggests that those with higher incomes have accumulated more savings.

For example, in central European countries such as France, there are large differences in the livelihoods of people living on different sides of the at-risk-of poverty threshold. Similarly, in many Eastern European countries, such as Poland, those living below the at-risk-of poverty threshold are much more likely to experience income difficulties than those not at risk of poverty.

Means to cover usual expenses often found

There may be less difficulty in paying for usual expenses because, for example, minimum pensions and other financial support in some countries (such as Finland) may be at a level that covers basic expenses but does not allow for savings. Consumption may also have been adapted to low incomes. It may also be easier to meet usual expenses if practical help, such as rides, is available from close relatives, in which case money can be saved for other usual expenses.

The main message from our research is that income alone does not tell us enough about older people’s livelihood. However, an adequate pension is the best guarantee for the livelihood of older people.

Attention should also be paid to ensuring that people are able to accumulate at least enough savings over their lifetime to be able to pay for major essential expenses, such as health care, in retirement.

A person is defined as living at risk of poverty if their household income is below 60% of the median income of the population.

Our article was published in the journal Ageing & Society (for subscribers)

The article is also available as a parallel publication in the open repository Julkari

Ithink that is among the so much vital injfo for me. And

i’m happy reading your article. But wanna remark on few common issues, The

website style is ideal, the articles is in reality nice : D.

Excellent process, cheers